Advertisement|Remove ads.

S&P 500 Heads For Worst January In 4 Years — But Most Retail Traders Still See Double-Digit Upside In 2026

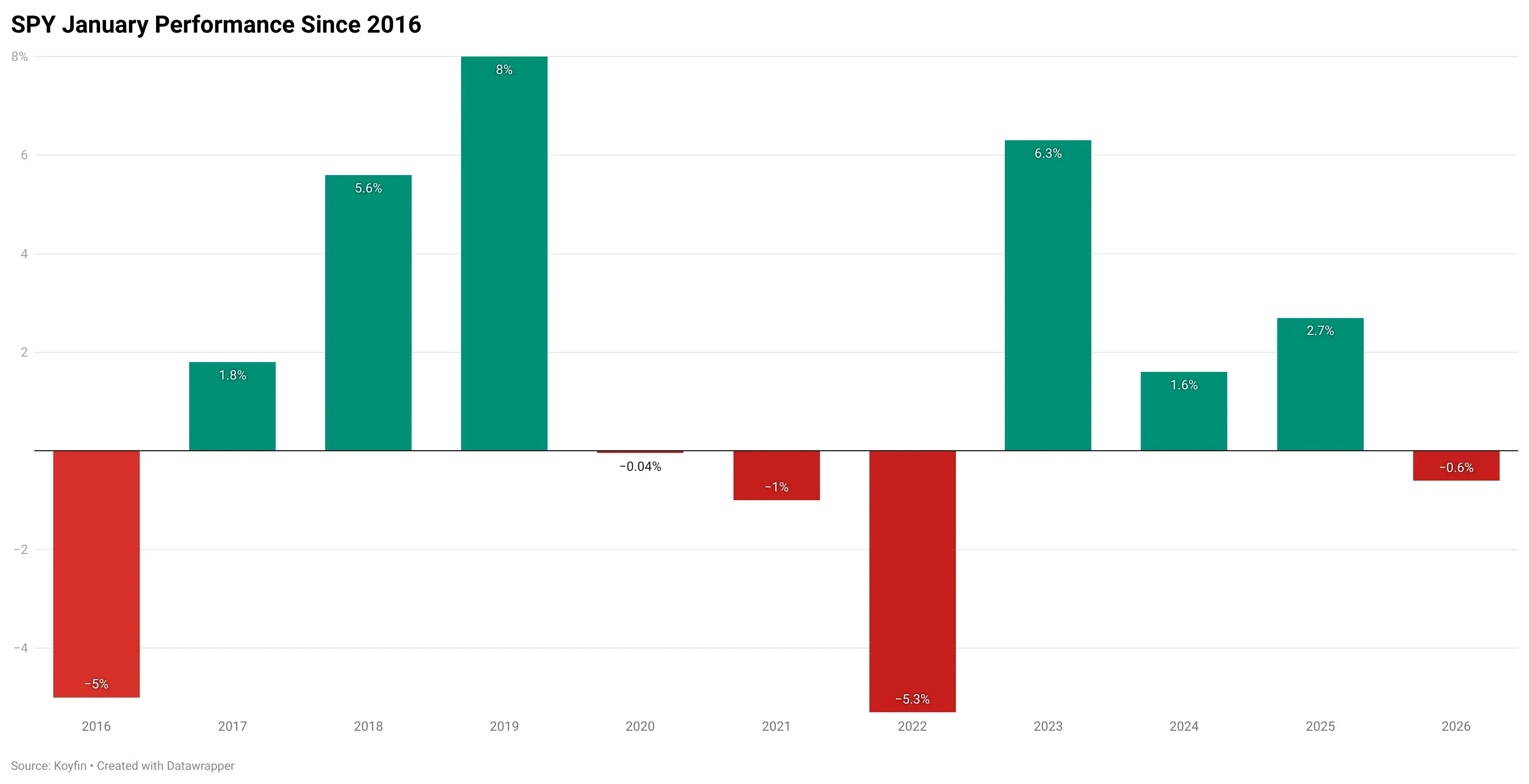

- The S&P 500 is tracking its weakest January since 2022, down about 0.6% month to date.

- Around half of the Stocktwits poll participants expect the index to gain 10% or more in 2026.

- Investor expectations remain split despite the slow start to the year.

The S&P 500 is on track for its weakest January in four years, even as a majority of retail investors expect the index to post gains in 2026.

The benchmark index has slipped roughly 0.6% month to date, on track for its worst January since 2022. A new Stocktwits poll reveals mixed outlooks for the year ahead. About 50% of voters in the poll, which has garnered around 7,000 votes, expect the S&P 500 to increase by 10% or more in 2026. Another 21% see the index gaining up to 9%.

On the downside, 11% of participants expect losses of 1% to 9%, while 18% expect the index to fall 10% or more.

January Track Record Shows Mixed Signals

Looking at historical performance, January results over the past decade have been slightly more bullish. From 2016 through 2025, the S&P 500 finished six Januarys in positive territory and four in the red.

During that period, strong January rallies were recorded in 2017, 2018, 2019, 2023, 2024 and 2025, while declines occurred in 2016, 2020, 2021 and 2022, with the current January of 2026 on track for losses amid increased geopolitical risks.

Easy Money Sets The Tone For 2026 Start

Dan Niles, founder of Niles Investment Management, told Schwab Network that he expects 2026 to begin on a supportive note, with liquidity conditions.

Niles pointed to the Federal Reserve’s December shift from selling bonds to buying about $40 billion a month in short-term Treasurys, alongside expectations of further rate cuts later this year. He also cited upcoming tax refunds for consumers and favorable tax treatment for corporate research and capital spending as near-term tailwinds.

He noted that the Russell 2000 has already risen about 8% year to date, calling the early performance notable.

Volatility Risks Seen Later In The Year

Niles said market conditions could turn more uneven toward the end of 2026, citing upcoming midterm elections, elevated valuations, and uncertainty around the sustainability of the AI trade.

He noted that the S&P 500 is trading near 25 times trailing earnings and said valuation measures such as enterprise value-to-sales remain above levels seen at the 2000 market peak.

Market Rotation Emerges Early In 2026

Charlie Bilello, chief market strategist at Creative Planning, highlighted leadership shifts so far this year.

In posts on X, Bilello said small-cap stocks have outperformed large caps, international equities have outpaced U.S. stocks, and value shares have beaten growth, while major technology names have lagged. Following Tuesday’s 2.1% drop in the S&P 500, Bilello said such declines are typical, noting that the average year since 1928 has seen 29 market drops of more than 1%.

He also referenced last October’s selloff tied to tariff concerns, pointing out that stocks rebounded quickly in the weeks that followed.

Goldman Forecasts Fourth Straight Year Of Gains

Goldman Sachs expects U.S. equities to extend their winning streak in 2026. The firm projects a 12% total return for the S&P 500 this year, compared with gains of 18% in 2025 and 25% in 2024. Goldman expects earnings per share to rise 12% in 2026 and 10% in 2027.

Chief U.S. equity strategist Ben Snider said continued economic growth, profit strength among large-cap stocks and increased AI adoption are expected to support earnings.

At the same time, Goldman flagged elevated valuations and high market concentration as key risks, noting that the largest technology stocks accounted for more than half of the index’s gains in 2025.

How Did Stocktwits Users React?

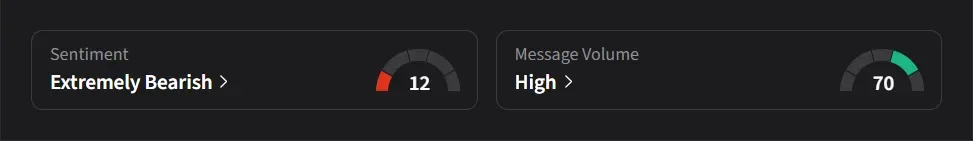

On Stocktwits, retail sentiment for the SPDR S&P 500 ETF Trust (SPY) ETF, which tracks the S&P 500, was ‘extremely bearish’ amid ‘high’ message volume. Retail interest in this ETF has been robust over the past year, as the benchmark index set new highs, with message volume nearly tripling and followers spiking by more than 13%.

One user said the S&P 500 may consolidate and see a short-term bounce before another pullback tied to liquidity conditions.

Another user said a short-term bounce could be ahead, noting that similar weekly breakdowns in the past were often followed by a next-day rebound.

The SPY index has risen 15% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2185805420_fotor_2025011795638_6fbb0bb63f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_jpg_64b4ea4fc0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_war_jpg_f2a208ae56.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_M_and_A_deals_acquisitions_resized_jpg_a56d5b5e28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)