Advertisement|Remove ads.

Scholar Rock’s Retail Following Jumps 77% After Therapy Trial Win, Firm Announces $275M Share Sale

Shares of biotech firm Scholar Rock Holding Corp. ($SRRK) dropped more than 9% on Tuesday following a massive 300% surge the previous day.

The company unveiled a $275 million underwritten public offering. Scholar Rock plans to offer both common stock and pre-funded warrants to investors, and said it will use the proceeds to fund the commercialization of its lead muscle-targeted therapy, apitegromab, as well as other clinical programs.

The offering is being managed by J.P. Morgan Securities LLC, Jefferies LLC, and Piper Sandler & Co., with BMO Capital, Wedbush Securities, and Raymond James serving as co-managers.

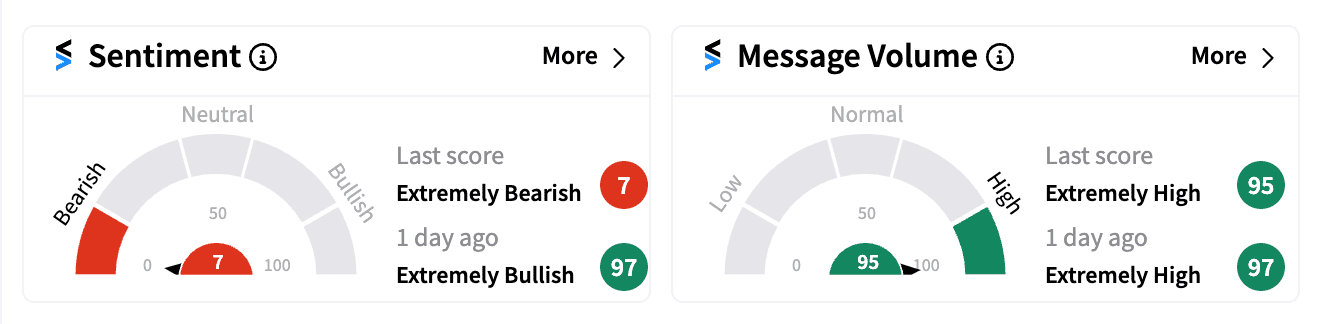

On Stocktwits, retail sentiment crashed to ‘extremely bearish’ (7/100) levels from ‘extremely bullish’ a day earlier following the news.

Scholar Rock’s move comes on the heels of its recent breakthrough in the Phase 3 trial of apitegromab, designed to treat spinal muscular atrophy (SMA).

The trial results showed a significant improvement in motor function, sending the stock soaring to levels last seen in November 2021.

The stock’s dramatic rise has also drawn considerable attention from retail investors.

The company’s following on Stocktwits surged by 77% within 24 hours of the trial announcement, while weekly message volume spiked by an astounding 117,700%.

SRRK shares are up over 75% year-to-date.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)