Advertisement|Remove ads.

Scholar Rock Ignites Retail Buzz As Stock Rockets 300% On Positive Muscle-Targeted Therapy Trial

Shares of Scholar Rock Holding Corp. (SRRK) soared over 300% on Monday, to levels last seen in November 2021, after the company announced positive results from a late-stage trial of its muscle-targeted therapy for spinal muscular atrophy (SMA).

The Phase 3 SAPPHIRE trial revealed that apitegromab, the company’s lead drug candidate, significantly improved motor function in SMA patients compared to a placebo, as measured by the gold-standard Hammersmith Functional Motor Scale Expanded (HFMSE).

The trial showed that 30% of patients receiving apitegromab experienced a more than 3-point improvement in HFMSE scores, compared to just 12.5% of those on placebo.

Notably, motor function improvements in apitegromab-treated patients were observed as early as 8 weeks into treatment, with benefits expanding at 52 weeks.

Following this success, Scholar Rock said it plans to submit a U.S. Biologics License Application and seek European Union marketing authorization in the first quarter of 2025.

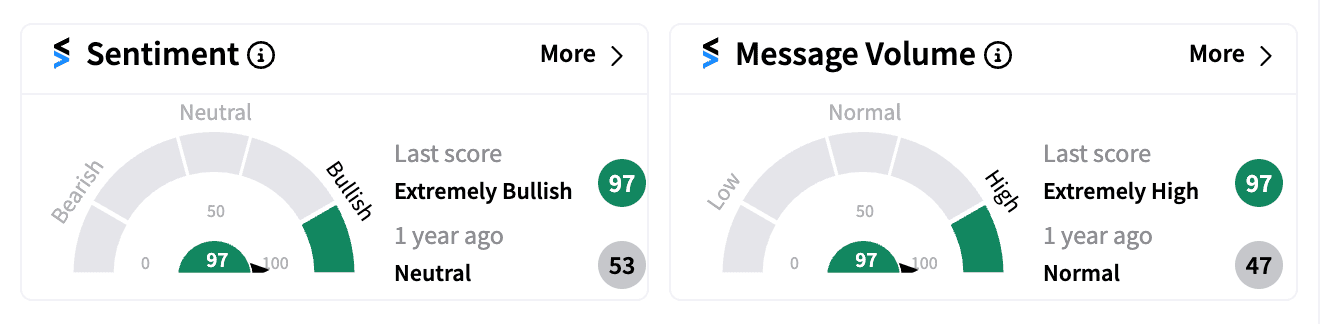

Retail sentiment on Stocktwits exploded, reaching an ‘extremely bullish’ score(97/100), the highest level seen in a year. The sharp increase in message volume reflected the excitement among retail investors.

One user predicted that SRRK might launch a share sale to take advantage of the surge, while another speculated it could reach the $50 mark by Monday.

In response to the trial success, Wedbush raised its price target on SRRK to $37 from $27, maintaining an ‘Outperform’ rating. The brokerage highlighted longitudinal comparisons suggesting a strong likelihood of regulatory approval, and revised its sales estimates upward.

Wedbush sees multiple opportunities for further stock appreciation over the coming year as clarity on subgroup performance and regulatory pathways emerges.

As of 11 a.m. ET, Scholar Rock was the top gainer on U.S. exchanges, with trading volume at 25 million shares, nearly 30 times its daily average.

Spinal muscular atrophy is a rare neuromuscular disease affecting 30,000 to 35,000 people in the U.S. and Europe, causing motor neuron loss, muscle atrophy, and progressive weakness.

In addition to its SMA treatment, Scholar Rock is also reportedly developing a therapy aimed at preserving lean muscle mass in patients experiencing rapid weight loss from GLP-1 drugs, a new class of weight-loss treatments.

SRRK stock is now up over 80% this year, outperforming broader market indices.

Editor's note: This article was updated with Wedbush's analytical note on SRRK following the trial results

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)