Advertisement|Remove ads.

SSR Mining Slides Aftermarket On Q4 Profit Miss, But Retail Stays Upbeat On Copler Mine Restart Timeline

Shares of SSR Mining Inc. (SSRM) fell 1.5% during after-market hours as the company’s fourth-quarter (Q4) earnings were significantly lower than Wall Street expectations.

SSR Mining’s Q4 earnings per share (EPS) stood at $0.10, nearly half of the estimated $0.19. The company posted revenue of $323.19 million, comfortably ahead of an estimated $262.15 million.

SSR’s bottom line was impacted by the incident at the Copler gold mine in Türkiye, which resulted in operations at the mine being suspended in February 2024. Nine employees lost their lives due to a slip on the heap leach pad, the company said.

Suspension of operations at the mine also resulted in maintenance costs of $108.7 million.

During Q4, SSR produced 124,154 gold equivalent ounces at an all-in cost of $1,857 per payable ounce. For the full fiscal year 2024, SSR’s production stood at 399,267 ounces, at an average price of $1,878 per payable ounce.

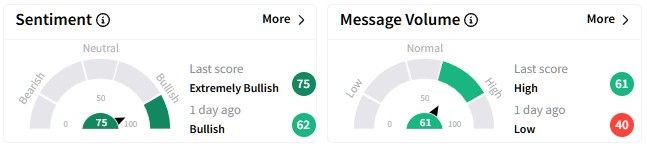

Despite missing the Q4 earnings estimate, retail sentiment on Stocktwits around the SSR Mining stock soared, entering the ‘extremely bullish’ (75/100) territory from ‘bullish’ (62/100) a day ago.

Message volume also surged to ‘high’ (61/100) levels from ‘low’ a day ago.

Retail users expressed optimism as the company offered an update on the status of the crucial Copler gold mine.

“When all necessary regulatory approvals, including the operating permits, are reinstated, it is anticipated that initial operations at Çöpler could restart within 20 days,” SSR Mining said.

However, it said there is no estimation yet about when operations at the mine will resume.

SSR Mining’s stock has been on an upward trajectory recently, gaining over 71% in the past six months.

Its one-year performance shines brighter, with the stock more than doubling during this period.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)