Advertisement|Remove ads.

Starbucks Stock Heads For Weekly Slide: Analyst Retains 'Buy' Call After Job Cuts, Store Closure Plans

Starbucks shares dropped 0.1% in early premarket trading on Friday, heading for a weekly drop. The previous day, Starbucks announced plans to close hundreds of underperforming cafes in the U.S. and Canada, aiming to save $1 billion in costs, the latest step in a year-long turnaround effort.

Investment research firm BTIG reiterated its 'Buy' rating on the company's shares and $105 price target. The store closures, which are expected to be completed over the next several days, appear to be roughly in line with investor expectations, representing approximately 4.5% of the company-owned North American portfolio, according to the analyst.

While noting the development as a positive, it believes that Starbucks' revival is taking longer than previously expected, and analysts are eagerly awaiting a return to positive transaction counts in the U.S. as the ultimate catalyst.

Currently, 17 of the 35 analysts covering the stock have a 'Buy' or higher rating, while 15 recommend 'Hold,' signaling a divide across Wall Street. Their average price target of $98.47 signals an over 17% upside from the stock's last close, according to Koyfin data.

Notably, Starbucks stock is down approximately 25% from its 2025 high, reached in late February, and 6.4% down year-to-date.

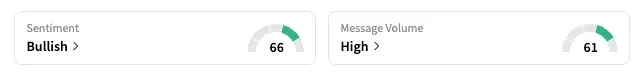

On Stocktwits, the retail sentiment for SBUX shifted to 'bullish' as of early Friday, from 'neutral' the previous day.

Meanwhile, Starbucks is inching closer to finalizing a stake sale in its China business, even as it advances with plans to modernize cafe interiors and menus.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Johnson_and_Johnson_jpg_bc42927ca0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2207639540_jpg_4ae2641504.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jamie_Dimon_July_736ff90d31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kashkari_original_jpg_b7db42a385.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199401088_jpg_656c1eacd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)