Advertisement|Remove ads.

Modelo Beer-Maker Constellation Brands’ Stock Falls After Mixed Earnings, Retail Mood Remains On The Rocks

Shares of Constellation Brands, Inc. (STZ) fell over 2% pre-market Thursday following the announcement of a fiscal second-quarter profit that topped estimates, but some concerns kept investor sentiment low.

The company, known for its brands including Modelo beer, Meiomi wine, and Svedka vodka, reported an adjusted profit of $4.32 per share, surpassing analysts’ expectations of $4.08.

However, revenue of $2.92 billion fell short of the consensus estimate of $2.95 billion. Additionally, Constellation booked a substantial non-cash loss of $2.25 billion on the value of its wine and spirits business.

Constellation raised the lower end of its adjusted earnings per share (EPS) guidance to a range of $13.60 to $13.80, up from $13.50 to $13.80, but reduced its net sales growth forecast from 6%-7% to 4%-6%.

CEO Bill Newlands said, “While the current macroeconomic backdrop has weighed on demand for beverage alcohol — and for consumer packaged goods, more broadly — we continued to deliver strong performance in Q2 of Fiscal ‘25.”

He noted that Constellation’s beer segment remained the top share gainer in its category.

CFO Garth Hankinson added that the company achieved its target net leverage ratio of approximately 3.0x and returned around $250 million to shareholders through share repurchases.

He also emphasized the deployment of incremental marketing investments in the beer business, supported by cost-saving and efficiency initiatives that exceeded initial expectations.

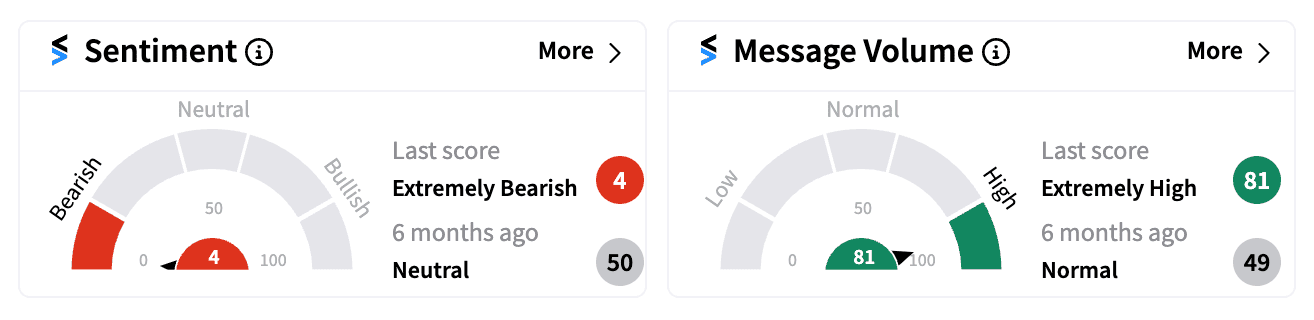

Still, retail sentiment on Stocktwits shifted to ‘extremely bearish’ (4/100), marking the lowest level this year.

One user expressed skepticism about $STZ reaching 275, citing the ongoing struggles of the wine and spirits division as a major obstacle.

As of Wednesday, the stock has gained 5.8% year-to-date, underperforming the Consumer Staples Select Sector SPDR ETF’s (XLP) 13.9% gains and the S&P 500 index’s 19.7% rise.

Read next: Retail Buzz For Levi Strauss Spikes After Dour Outlook Sends Stock Tumbling

/filters:format(webp)https://news.stocktwits-cdn.com/large_federal_reserve_jpg_662b8de718.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2022/12/NTPC.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_xi_jinping_jpg_f2aa8420ba.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_scott_bessent_jpg_9e8c1c871b.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/02/DLF-shutterstock.jpg)