Advertisement. Remove ads.

Retail Buzz For Levi Strauss Spikes After Dour Outlook Sends Stock Tumbling

Shares of Levi Strauss & Co. (LEVI) dropped 10% pre-market Thursday, continuing a sharp sell-off following the company’s disappointing outlook.

The jeans maker tempered its full-year sales forecast late Wednesday and revealed it is considering selling its struggling Dockers business, which rattled investors.

Levi Strauss posted Q3 adjusted earnings per share of $0.33, beating consensus estimates of $0.31.

However, revenue came in at $1.52 billion, falling short of the $1.55 billion forecasted by analysts.

CEO Michelle Gass emphasized the strength of the core Levi’s brand, which saw 5% global growth in the quarter — marking its highest revenue growth in two years.

Gass also highlighted progress in direct-to-consumer sales and positive performance in both the U.S. and Europe.

Looking ahead, the company said it is focusing on amplifying the Levi’s brand with new initiatives, including a campaign featuring Beyoncé and an innovative product pipeline aimed at driving future growth.

On Wall Street, the reaction was mixed.

Stifel lowered its price target on Levi Strauss to $25 from $28, maintaining a ‘Buy’ rating, while JPMorgan raised its price target to $21 from $20, keeping a ‘Neutral’ rating.

Analysts remain cautious about the company’s full-year outlook, with Stifel noting that while brand health indicators remain strong, ongoing challenges, such as weaker revenue growth, continue to weigh on the stock.

The company’s restructuring efforts, including its exit from the Denizen flexible pants and footwear businesses, alongside cost-cutting and a renewed focus on denim offerings, are seen as moves to attract cost-conscious shoppers amid inflationary pressures.

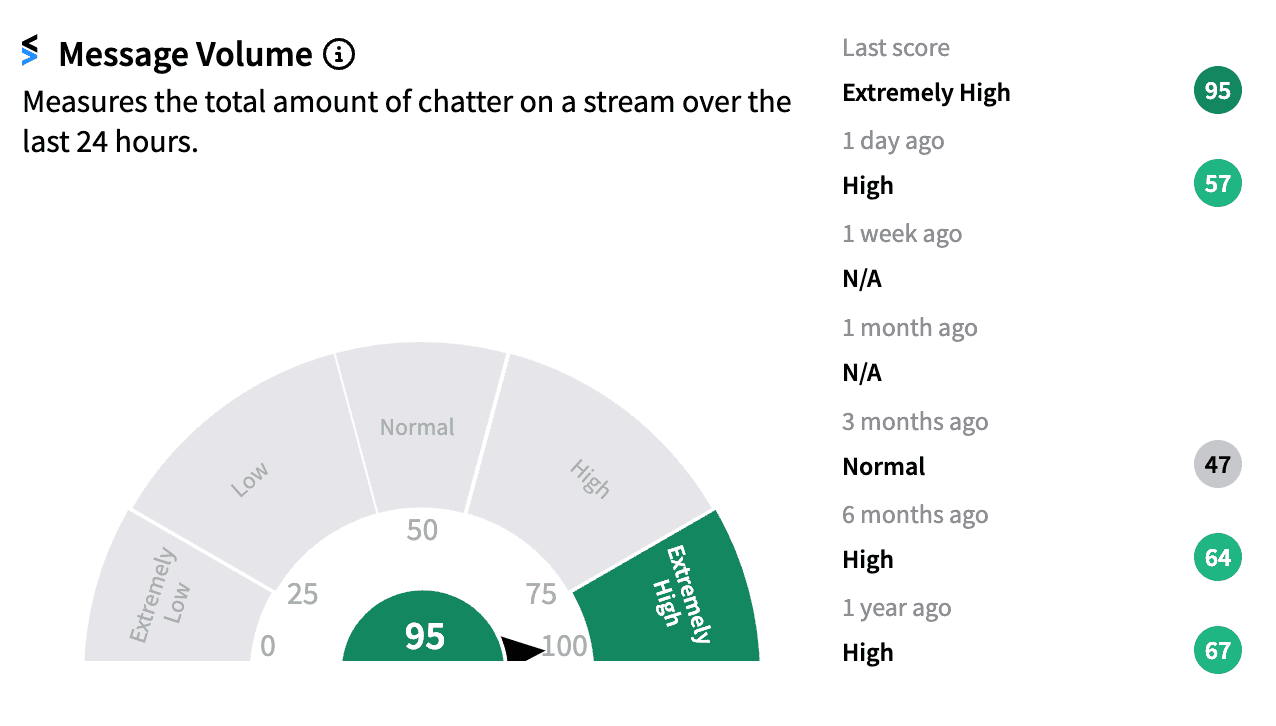

Retail buzz on Stocktwits surged to an “extremely high” rating (95/100) early Thursday as message volume spiked around Levi Strauss & Co. ($LEVI).

Some bearish users suggested Levi’s was not the iconic same brand as it once was, dubbing the company as one that sold overpriced jeans.

One user was cautiously optimistic, pointing out that they would turn bullish again if LEVI broke through a

“key resistance” at $22.82.”

Levi Strauss shares are still up nearly 30% year-to-date.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_chart_trending_march_jpg_ad3a86ed42.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_stock_jpg_1a4860daf4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2018/10/2018-10-25T140852Z_1_LYNXNPEE9O1CZ_RTROPTP_4_INDIA-REGULATOR-BREWERS.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/07/2025-07-01t112017z-2-lynxmpel601uq-rtroptp-4-britain-court-getty-stabilityai-2025-07-77c288b7c6ea5058b94f0190114fe35e-scaled.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229958057_jpg_d8a312f73d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)