Advertisement|Remove ads.

Super Micro Retail Traders Downbeat Despite Stock's Nearly 10% Sell-Off: Investors Largely Shrug Off Expanded Nvidia Partnership

Super Micro Computer, Inc. (SMCI) stock plunged on Tuesday amid the broader market sell-off, which disproportionately hurt the tech space. Notwithstanding the pullback, the stock was in the green for the year, yet retail sentiment remains bearish.

A couple of announcements about an expanded Nvidia Corp. (NVDA) partnership failed to revive the dour sentiment.

During the trading hours, Super Micro, a maker of artificial intelligence (AI) servers, announced support for the new Nvidia RTX PRO 6000 Blackwell Server Edition graphic processing units (GPUs) on a range of workload-optimized GPU servers and workstations.

This broad range of servers optimized for the NVIDIA Blackwell generation of PCIe GPUs will enable more enterprises to leverage accelerated computing for LLM-inference and fine-tuning, agentic AI, visualization, graphics & rendering, and virtualization.

After the market closed, Super Micro also announced new systems and rack solutions powered by NVIDIA's Blackwell Ultra platform.

“Supermicro and NVIDIA's new AI solutions strengthen leadership in AI by delivering breakthrough performance for the most compute-intensive AI workloads, including AI reasoning, agentic AI, and video inference applications,” it added.

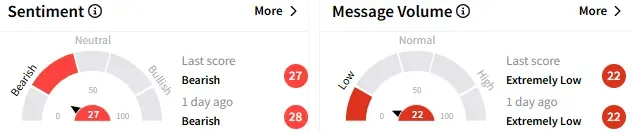

On Stocktwits, sentiment toward Super Micro stock remained ‘bearish’ (27/100) and the message volume continued to be ‘extremely low.’

A bearish watcher expects the stock to drop to the $20s level.

Another user said lifting the sagging stock would take more than a “twinkling” of positive news. They warned that the bottom may be giving away if the weakness continues into Wednesday’s session.

The stock ended the after-hours session up 0.79% at $37.90.

Super Micro stock is up over 24% for the year, although it trades well off the $122.90 intraday high reached on March 8. The shares have moved in a 52-week range of $17.25-$110.61.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2177851484_jpg_b969f68c05.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)