Advertisement|Remove ads.

Super Micro Stock Sees 400% Jump In Activity On Stocktwits As Trump Tariffs Roil Market

Super Micro Computer, Inc. (SMCI) stock rebounded nicely on Monday from the tariff-induced sell-off seen in the previous two sessions.

The artificial intelligence (AI) server maker’s stock jumped 10.66% to $33 in Monday’s regular session and gained an incremental 2.79% in the after-hours session.

The sweeping reciprocal tariffs announced by President Donald Trump last week hit the market hard, with the S&P 500, a broader market gauge, pulling back by nearly 11% since Thursday. According to Bloomberg, the global stock markets lost a whopping $10 trillion over the three sessions.

Super Micro’s resilient comeback was fueled by a reversal in sentiment toward tech stocks, especially semiconductor and communication services stocks.

The rebound set retail tongues wagging, as the chatter on the Super Micro stock stream spurted by nearly 400% over 24-hours ended late Monday.

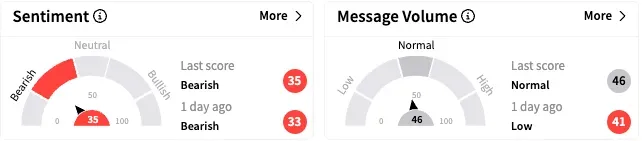

However, retail sentiment toward Super Micro stock stayed ‘bearish’ (35/100) but the message volume improved slightly to ‘normal’ level.

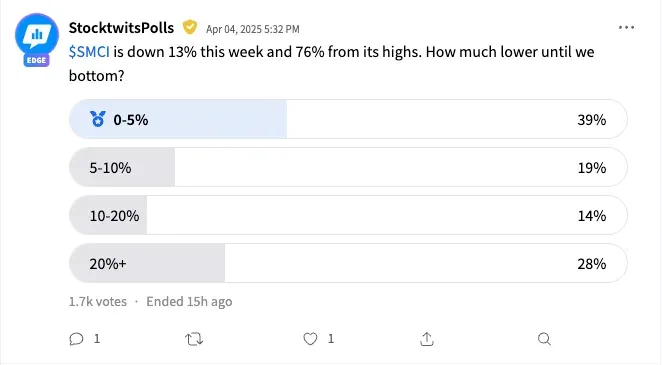

A Stocktwits poll that received responses from 1,700 users found that a cumulate 61% of the respondents expect Super Micro stock to fall by 5% or more before it bottoms in the current down cycle.

Of this, 28% expect a 20% or more sell-off.

That said, a sizable proportion (39%) braced for a more shallow sell-off (5% or less downside) before a bottom is hit.A bearish user highlighted the inherent risks Super Micro faces and said the stock is “highly vulnerable” to any earnings miss or market sentiment shift.

Other users also flagged extraneous risks of the worsening of the U.S.-China trade war, and potential Taiwanese invasion by China, which would put the global semiconductor supply chains at risk.

Super Micro stock is up about 8.3% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)