Advertisement|Remove ads.

Swing-Trade Bet On KRN: SEBI RA Recommends Buying On Pullback Near ₹800

KRN Heat Exchanger and Refrigeration is on the analyst’s radar, driven by its 12% rally in the last one week.

SEBI-registered analyst Krishna Pathak suggests a swing investment opportunity in this stock, and sees an accumulation zone on a dip towards ₹800–₹820.

He highlighted that KRN is a fast-growing niche player in the HVAC heat-exchanger space, blending strong product credentials with robust growth and global OEM tie-ups. However, its stretched valuation and cyclical exposure warrant caution.

Bullish Continuation Pattern

On the technical side, the chart structure suggests a potential breakout-retest setup, offering a favorable opportunity for swing to short-term positional entries, according to Pathak. He added that accumulation can be considered on meaningful pullbacks or consolidation near support.

KRN stock is currently consolidating within a range, with resistance near ₹850 and strong support around ₹710. The analyst said that the ₹800–₹820 zone presents an attractive add-on accumulation opportunity, supported by prior buying activity.

Stochastic Relative Strength Index (RSI) indicates overbought conditions, suggesting possible short-term consolidation before the next move. Pathak notes that a decisive breakout above ₹850 can unlock momentum towards ₹970–₹1,080. However, a breakdown below ₹710 may signal a deeper corrective move.

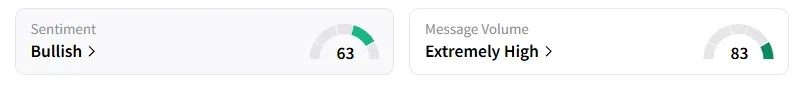

Data on Stocktwits shows that retail sentiment on this counter turned ‘bullish’ a week ago, amidst ‘extremely high’ message volumes.

KRN shares have gained 20% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)