Advertisement|Remove ads.

Talkspace Stock Surges on Earnings Beat: Retail Sentiment Brightens

Behavioral Health services-focused Talkspace’s ($TALK) stock jumped nearly 19% on Tuesday as of 3:20 pm ET after the company posted better-than-expected third-quarter earnings, with retail sentiment and activity staying elevated.

The New York-based company’s revenue increased 23% year-on-year to $47.4 million, narrowly missing analyst expectations. Its Earnings Per Share (EPS) came in at one cent, beating analyst estimates for a breakeven quarter.

For the third quarter, it posted net income of $1.9 million, compared to a net loss of $4.4 million in the same quarter in 2023, driven by strong revenue growth. Its adjusted EBITDA was $2.4 million in the most recent quarter.

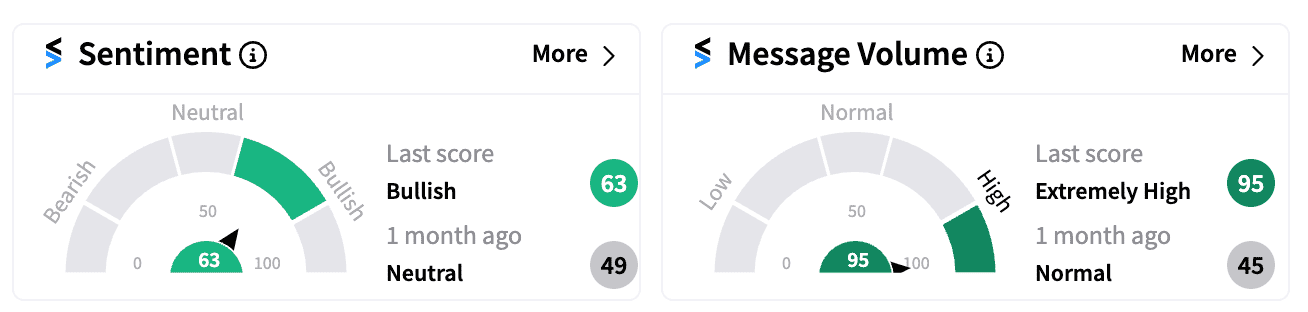

Retail sentiment on the stock has turned ‘bullish’ from its ‘neutral’ level last month. Meanwhile, message volumes jumped from ‘high’ to ‘extremely high’ as investors discussed the results.

“Talkspace delivered solid third quarter financial results with 23% revenue growth and our third consecutive quarter of adjusted EBITDA profitability. We have made meaningful strides in fortifying our relationships with key payor partners who view us as the leading full-scale, pure-play behavioral health provider and truly recognize the importance of our differentiated focus on clinical excellence,” Dr. Jon Cohen, CEO of Talkspace, said in a statement.

Cohen highlighted the ongoing “mental health crisis” in the US as he noted the company’s efforts towards building an “innovative” behavioral telehealth network that reaches more than 158 million people now, including the elderly, teens, and members of the US military. Last week, the company announced a partnership with Wisdo Health, an AI-powered social health and peer support platform focused on combating loneliness.

Talkspace expects fiscal year 2024 revenue to range from $185 to $195 million, a growth rate of 23-30%, and adjusted EBITDA of $4 to $8 million.

One Stocktwits user was bullish on the growing demand for the company’s services.

Another sees an improving technical picture that points to higher prices.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_972233966_jpg_8caf04ff29.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_jpg_b9978efee1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1900667215_jpg_7d21d3da39.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194779803_jpg_36869e0838.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_Red_jpg_6e38585da8.webp)