Advertisement|Remove ads.

Macro Drag Vs. Smart Money: What Will Drive Bitcoin’s Next Move?

- Popular chartist, Rekt Capital, said that Bitcoin's weekly structure is starting to look like the transition from 2021 to 2022, with weaker rebounds and repeated refusals from long-term EMA resistance.

- The analyst says that higher lows are not a sign of bullishness unless BTC breaks the macro downtrend and regains important technical levels as support.

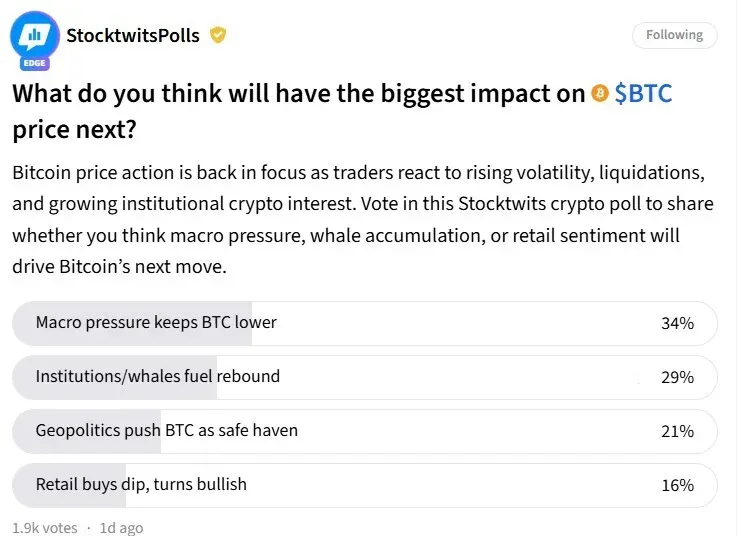

- A Stocktwits poll shows that people have mixed feelings about the market. Some people are worried about macro pressure, while others think that whales, ETFs, and corporate flows will bring back momentum.

- Commentator SCNC says that leveraged shorts, not fundamentals, have caused Bitcoin's price to go down.

Bitcoin's (BTC) technical structure is showing early warning signs as the crypto markets struggle to gain ground.

In a YouTube video released on Friday, analyst Rekt Capital said that BTC's current setup looks more and more like the bear market of early 2022. He pointed to repeated rejections at important resistance levels and a weakening rebound strength.

The chartist broke down Bitcoin’s weekly structure, which he said reflects the period of the gap between the bull market of 2021 and the bear market of 2022. He pointed towards descending triangles, long-term Exponential Moving Average (EMA) resistance, and the failure to reclaim macro trendlines, which he said have weakened Bitcoin's rebound strength.

“Each rebound from support becomes weaker than the last,” said the analyst, suggesting that bid-side liquidity appears to be thinning with each test of support.

Why The Higher Low Isn’t Enough For Bitcoin?

While Bitcoin does follow historical patterns, bulls have suggested that the macro low for the asset isn’t as bad as historically seen. While Rekt Capital doesn’t disengage from that argument, he says there’s a caveat. He argued that higher lows are only bullish if they are accompanied by a trend reversal- breaking the macro downtrend.

He suggested that in a healthy bull market, price reclaims the EMA zone. However, what he sees is Bitcoin failing to reclaim the EMA zone and continuing to trade below it. He positions the current movement as a first-quarter “relief cluster.”

Bitcoin (BTC) was trading at $88,932.59, down 0.9% in the last 24 hours. On Stocktwits, retail sentiment around Bitcoin remained in ‘bearish’ territory, accompanied by ‘normal’ chatter levels over the past day.

What Are Market Watchers Saying?

In a StockTwits poll named ‘What do you think will have the biggest impact on $BTC price next?', around 34% market watchers were convinced that Bitcoin’s price is struggling due to ‘macro pressure.’

29% believe that whales, corporate treasuries, and ETFs could revive Bitcoin’s price. Interestingly, 21% voted ‘Geopolitics push BTC as [a] safe haven’, especially as President Trump stated that a U.S. ‘armada’ is heading toward Iran on Friday. However, only 16% believe that Bitcoin’s price could pump up as retail investors would buy the dip.

One participant named SCNC argued that Bitcoin’s price is artificially suppressed by leverage shorts, meaning the downside was flow-driven and not fundamentally dependent on macro-pressure. He also believes that with silver and gold hitting record levels on Friday, capital that flowed into gold and silver would eventually rotate back to Bitcoin. What SCNC is most bullish on is the net supply for Bitcoin falling 500,000 BTC per year, given that exchange balances keep declining.

Read also: Coinbase Bitcoin Premium Stays Underwater While Demand Turns Negative

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)