Advertisement|Remove ads.

Target Stock In Focus Post-Q4 As Tariff Worries Loom, But Retail Sees A Buy Opportunity

Shares of Target Corp rose 0.4% in after-hours trade on Tuesday after falling 3% earlier on potential impact of tariffs, following the company’s better-than-expected earnings, with retail sentiment turning bullish.

Target reported Q4 adjusted earnings per share at $2.41, above the consensus of $2.25. Its Q4 revenue came in at $30.92 billion, above estimates of $30.38 billion.

The Q4 performance was credited to higher traffic, strong digital sales and improved discretionary performance. It posted Q4 comparable sales growth of 1.5%, with 8.7% growth in digital comparable sales.

"Our team grew traffic and delivered better-than-expected sales and profitability in our biggest quarter of the year," said Brian Cornell, chair CEO of Target.

"Results were led by strong performance in Beauty, Apparel, Entertainment, Sporting Goods and Toys. As we look ahead, our continued investments in digital capabilities, stores and supply chain combined with a focus on newness, value, speed and reliability will further differentiate our one-of-a-kind physical and digital shopping experience.”

However, Cornell also warned of higher prices, telling CNBC that steeper produce prices as a result of President Donald Trump's tariffs are likely in the next couple of days. Mexico and Canada have both been slapped with 25% tariffs that could see prices rise for many commodities including strawberries, avocados and bananas, Cornell warned.

Target projected FY25 adjusted EPS between $8.80 and $9.80, compared to consensus of $8.70. Net sales growth is projected to grow around 1%, reflecting comparable sales growth to be around flat.

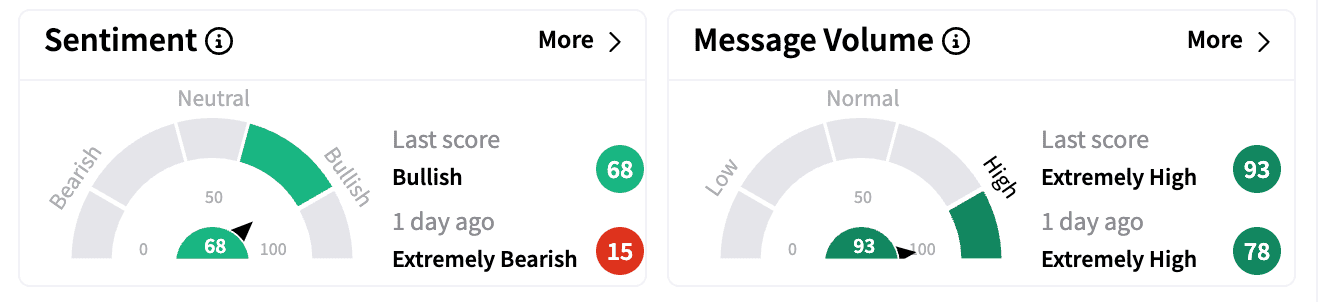

Sentiment on Stocktwits improved to ‘bullish’ from ‘extremely bearish’ a day ago. Message volume inched up in the ‘extremely high’ zone.

One bullish trader noted how buyers came in and “created a nice hammer” on Tuesday.

However, one bearish commenter called the tariffs ‘pointless’ that are worsening an 'economic catastrophe' not seen since the Great depression.

Target stock is down 13.3% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244297865_jpg_34f8b38611.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_corsair_gaming_jpg_f2eebff8d4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2214866166_jpg_efcc3db1cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_original_jpg_285085becb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)