Advertisement|Remove ads.

Tata Motors Stock Rallies After Trump's Tariff U-Turn, But Retail Traders Remain Cautious

Tata Motors shares rallied on Tuesday morning, surging nearly 5% after U.S. President Donald Trump signaled a softer stance on auto tariffs.

The stock, which has been volatile over the past few trading sessions, touched intraday highs last seen nearly two weeks ago.

In a statement on Monday that marked a notable shift, Trump said he is considering giving carmakers more time to adapt their supply chains before new tariffs are enforced.

"I'm looking for something to help some of the car companies, where they're switching to parts that were made in Canada, Mexico and other places, and they need a little bit of time because they're going to make them here," he said.

The news triggered a rally in U.S. auto stocks, with Ford and General Motors rising up to 4%. Asian automakers like Toyota, Honda and Hyundai were also gaining on Tuesday.

SEBI-registered analyst A&Y Market Research said on Stocktwits that Tata Motors could rally to ₹677 or ₹793 if momentum holds, though weakness below ₹500 could trigger downside.

The stock remains over 50% below its all-time highs hit on July 29, 2024.

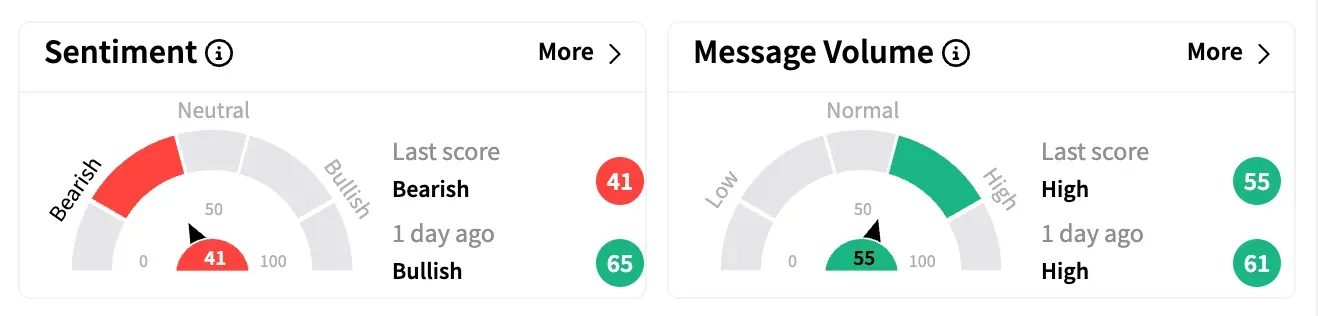

However, data from Stocktwits shows retail sentiment remains 'bearish' amid broader concerns over global trade and EV transition challenges.

Tata Motors has recently faced concerns over the performance of its luxury vehicle arm, Jaguar Land Rover, in key markets like China, the UK, and the U.S., as well as its domestic car business.

The company has substantial exposure to the U.S. market through its subsidiary Jaguar Land Rover (JLR), with America accounting for nearly 24% of JLR’s global sales in 2024. Investor sentiment took a blow after JLR temporarily halted U.S. exports in response to Trump’s initial tariff announcements.

Tata Motors is down 16% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_b1a99c6298.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243572319_jpg_90770a5e51.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_Social_logo_1200_Px_resized_jpg_86883cac04.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243387433_jpg_9712a99e81.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227049575_jpg_fe5b82901f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)