Advertisement|Remove ads.

Tesla Hikes Model Y And Model 3 Lease Prices In US After EV Tax Credit Expiry

Tesla (TSLA) has increased lease prices on its mass-market vehicles in the U.S. following the expiration of the federal tax credit for EV purchases.

Until September 30, new EV purchases were eligible for a federal tax credit of $7,500, while used EV purchases were eligible for $ 4,000, bringing down the purchase price for eligible customers. However, the credit expired on September 30, and Tesla subsequently hiked the lease price on its best-selling Model Y SUV to $529 to $599 per month, up from $479 to $529 previously, according to Reuters.

The Model 3 lease prices now range from $429 to $759 per month, up from $349 to $699, the report noted.

TSLA shares traded 1% lower in the pre-market session on Wednesday. On Stocktwits, retail sentiment around TSLA stock fell from ‘bullish’ to ‘neutral’ territory over the past 24 hours, while message volume stayed at ‘normal’ levels.

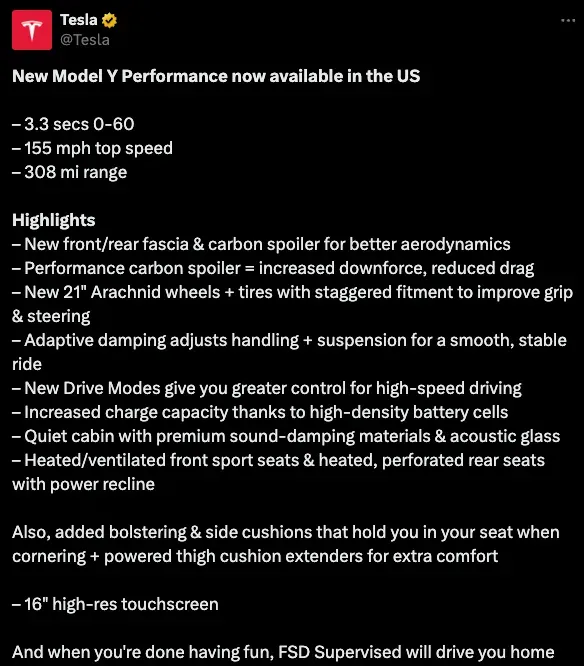

Separately, Tesla also launched the Performance variant of the Model Y SUV on Tuesday. The most premium variant of the SUV has a starting price of $57,490. However, the vehicle is not available for lease.

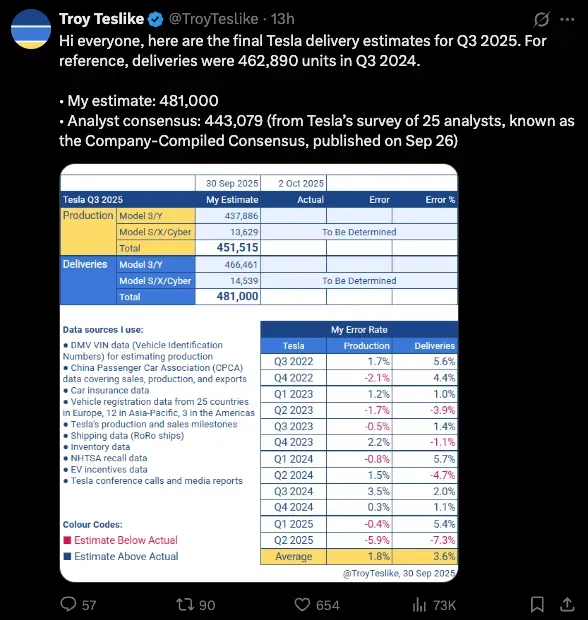

Tesla is now slated to report its third-quarter (Q3) deliveries on Thursday. Analysts on average expect the company to deliver approximately 441,500 vehicles, which is higher than the first two quarters of this year but lower than the 462,890 reported in Q3 2024, according to Reuters. However, Tesla delivery tracker Troy Teslike expects the company to deliver 481,000 deliveries for the three months through the end of September.

TSLA stock is up by 10% this year and by 72% over the past 12 months.

Read also: Dow Futures Fall As US Government Shuts Down: NKE, LAC, OXY, ARM Among Stocks To Watch

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)