Advertisement|Remove ads.

Tesla Stock Pares Gains Below Record Highs As Q4 Delivery Cuts Steal Spotlight From Musk Pay Package Ruling

- UBS and Deutsche Bank lowered fourth-quarter delivery forecasts, citing weaker demand in key markets.

- Analysts warned lower volumes could pressure margins despite optimism around autonomy and robotaxi plans.

- Musk’s reinstated pay package drew less attention as near-term delivery risks took focus.

Shares of Tesla pared gains below recent record highs on Tuesday as a weaker fourth-quarter delivery outlook from Wall Street analysts overshadowed investor focus on the recent court decision reinstating CEO Elon Musk’s pay package.

The stock ended Monday up 1.6%, but remained below the recent intraday record high of $498.26.

Q4 Outlook Weighs On Shares

UBS analyst Joseph Spak cut his estimate for Tesla’s fourth-quarter deliveries to about 415,000 vehicles from 429,000, putting the revised forecast roughly 5% below consensus.

In the fourth quarter of 2024, the company produced about 459,000 vehicles, and delivered more than 495,000 vehicles.

In a research note issued late Monday, Spak said the downgrade reflects softer U.S. deliveries following the expiry of the $7,500 federal EV consumer tax credit at the end of September. UBS reiterated its ‘Sell’ rating on the stock and its $247 price target.

Deutsche Bank Flags Margin Pressure

Deutsche Bank analyst Edison Yu also expects Tesla’s fourth-quarter deliveries to miss expectations, forecasting about 405,000 vehicles, driven by weaker volumes in the U.S. and Europe and a smaller decline in China, according to a report by Investing.

Yu said lower deliveries are likely to weigh on profitability, projecting automotive gross margin excluding credits at 14.4%, down 100 basis points sequentially. Looking beyond the quarter, he said full-year delivery expectations remain too high, modeling about 1.62 million vehicles for 2025 versus consensus near 1.66 million, while maintaining a bullish longer-term view tied to Tesla’s robotaxi and humanoid initiatives and raising his price target to $500.

Pay Package Takes Back Seat

The delivery downgrades came shortly after Delaware’s highest court reinstated Elon Musk’s 2018 compensation package, reversing a lower-court ruling that had voided the award in 2024.

In a unanimous decision, the Delaware Supreme Court said rescinding the package left Musk uncompensated for six years of work and that full cancellation was an inequitable remedy.

The stock-based plan, originally approved by Tesla shareholders in 2018 and again in 2024, was initially valued at about $56 billion. In November, shareholders also approved a separate, performance-based pay plan that could be worth up to $1 trillion over the next decade, tied to milestones including earnings growth, vehicle deliveries, robotaxis and humanoid robots.

Autonomy Narrative Still In Focus

Tesla’s longer-term valuation continues to be supported by its autonomy ambitions. On Monday, Musk said in a post on X that Tesla’s full self-driving driver assistance technology could “hopefully” be available in the United Arab Emirates starting next month. Tesla’s FSD system is currently available in select markets including the U.S., Canada, Mexico and China, with potential approvals in parts of Europe targeted for 2026.

How Did Stocktwits Users React?

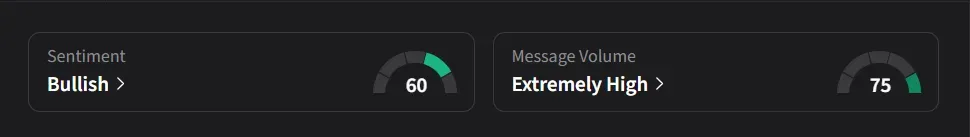

On Stocktwits, retail sentiment for Tesla was ‘bullish’ amid ‘extremely high’ message volume.

One user suggested the rally may have peaked for now, predicting a pullback toward the $420 level.

Another user said the chart looks bullish, expecting a brief move above $500 before a pullback and a renewed climb toward $520 by February.

Tesla’s stock has risen 21% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)