Advertisement|Remove ads.

This Chinese Media Minnow’s Stock Pops 46% On $100M Web3 Push Powered By Bitcoin, Ethereum: Retail Traders Pile In

U.S. shares of the little-known Chinese media company, Pop Culture Group, surged 46% on Thursday after it announced a major play in cryptocurrencies.

Pop Culture said it will accumulate 1,000 bitcoins and set up a $100 million "Crypto Pop Fund" by next year.

The plan for the fund was first revealed on Sept. 18. The company would accumulate Bitcoin, Ethereum (ETH), and Hyperbot (BOT) to invest in Web3 technologies and projects associated with its core business. The company acquired $33 million-worth of bitcoins, it said at the time.

"Our strategic cryptocurrency investment marks the beginning... (of) a global Web3 pan-entertainment super ecosystem," CEO Huang Zhuoqin had said.

Incorporated in the Cayman Islands, with its main operations based in China, Pop Culture produces events and content for television and film, and offers artist management services. The company listed its shares on the Nasdaq in June 2021 and had a market cap of $30.6 million as of Thursday.

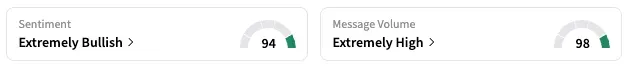

On Stocktwits, the retail sentiment for CPOP stock turned 'extremely bullish' (94/100) even as the stock pared some of the gains in extended trading.

Pop Culture's move is part of a wave of companies retooling their businesses to focus on cryptocurrencies. Several U.S. companies, including GameStop, have recently established cryptocurrency reserves, seeking to capitalize on the rising prices of these assets.

Year-to-date, CPOP stock has increased by 75%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Williams-Sonoma, RH, Wayfair Stocks Fall After-Hours As Trump Slaps Tariffs On Furniture, Cabinets

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jim_cramer_OG_2_jpg_b3d8e3bbe7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)