Advertisement|Remove ads.

This Confectionery Stock Turned Retail Investors Cautious Ahead Of Earnings, But Wall Street Has A Different Take

Retail investors turned cautious on Hershey (HSY) ahead of the quarterly earnings report on Wednesday as they eye more details regarding price hikes and tariff-related expenses.

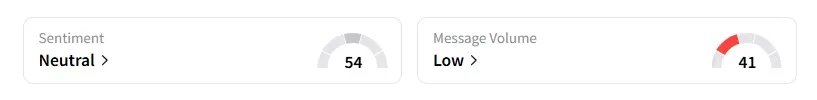

On Stocktwits, retail sentiment dipped into the ‘neutral’ territory, compared to ‘bullish’ a day ago. The message volume was at ‘low’ levels. Shares of Hershey traded marginally in the green during midday trading.

Stifel raised its price target on Hershey to $180 from $160 and maintained a ‘Hold’ rating, according to TheFly. The brokerage said it is approaching the second-quarter earnings season "with caution" for its covered food stocks, stating that weak consumption trends continued into the quarter.

In July, several media reports said Hershey informed retailers that it would be taking a double-digit price increase on average across its confectionery portfolio due to a surge in the costs of cocoa.

Last week, Piper Sandler raised its price target on Hershey to $145 from $120 and stated that it was updating its model for more realistic cocoa costs, as its model had reflected a sharp drop in cocoa futures that has yet to materialize and may not be coming soon.

Tariffs remain a wild card, with few clear mitigation options, Piper Sandler added.

Hershey is expected to post second-quarter net sales of $2.52 billion, an 8.8% increase year-over-year, and earnings per share (EPS) are estimated to be $1, according to data compiled by Fiscal AI.

In early July, Hershey tapped Wendy’s (WEN) CEO Kirk Tanner to lead the chocolate maker, marking a key step in its planned leadership transition launched earlier this year.

The stock has risen over 9% so far this year and has fallen nearly 5% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Walmart Nets Multi-Year MLS Deal, Investors Stay Bullish As Retailer Eyes Soccer Fandom

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2166123192_jpg_1bb818cd90.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Civic_resized_jpg_120d89cac4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Opendoor_Technologies_jpg_177252e1f8.webp)