Advertisement|Remove ads.

This Logistics Stock Tumbled 10% After Downbeat Q2 Earnings, But Retail’s Eyeing Buy-On-Dip Opportunities: Details Inside

United Parcel Service Inc. (UPS) CEO Carol Tomé highlighted that the U.S. small package delivery market faced challenges due to weak consumer confidence in the second quarter (Q2) despite the broader U.S. economy remaining stable.

In the Q2 earnings call, Tomé said shipments from China to the U.S. fell significantly in May and June, with average daily volumes down 34.8% from a year earlier following new tariffs.

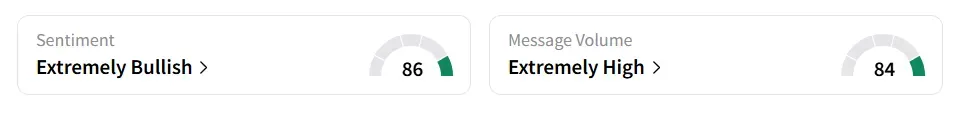

United Parcel Service stock traded over 9% lower on Tuesday afternoon, but retail sentiment toward the stock improved to ‘extremely bullish’ (86/100) from ‘neutral’ territory.

Message volume jumped to ‘extremely high’ (84/100) from ‘low’ levels in 24 hours. The stock’s user message count exploded 585% in 24 hours.

Stocktwits users said they are buying the dip.

The global logistics company’s Q2 revenue declined 2.7% year-on-year (YoY) to $21.2 billion, beating the analysts’ consensus estimate of $20.853 billion, as per Fiscal AI data.

Adjusted earnings per share (EPS) of $1.55 missed the consensus estimate of $1.57.

UPS posted an operating margin of 8.6%, a 30-basis-point decrease YoY.

"Our China to U.S. trade lane is our most profitable trade lane, and the volume decline here pressured our international operating margin,” said Tomé.

The company said it is making progress on its ‘Efficiency Reimagined’ and network overhaul plans, which are expected to yield $3.5 billion in full-year savings.

The earnings included a $29 million net charge, mainly tied to transformation-related costs of $57 million.

While UPS declined to issue full-year revenue or profit forecasts due to economic uncertainty, it reaffirmed capital spending plans of $3.5 billion and projected dividend payouts of approximately $5.5 billion, pending board approval.

United Parcel Service stock has lost 27% in 2025 and over 28% in the past 12 months.

Also See: Spotify CEO Highlights This Major Milestone In Europe: Retail’s Mulling Going Long On The Stock

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239226376_jpg_c72fd10c8b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_App_Lovin_jpg_42d40549b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)