Advertisement|Remove ads.

Time Technoplast Signs ₹200 Cr Packaging Deal, SEBI Analyst Sees Momentum Ahead

Time Technoplast shares rose on Monday after the company signed a memorandum of understanding (MoU) to acquire a 74% stake in Ebullient Packaging (EPPL). The deal valued EPPL at approximately ₹200 crore and is expected to be completed within the next four to six months, with funding provided in cash and subject to due diligence.

This deal enables Time Technoplast to enter the fast-growing flexible packaging (FIBC) market, complementing its existing leadership in rigid packaging. Analysts said that this also helps expand the company’s product range and deepen customer reach across 11 countries.

The stock has gained 5% in the last month after it announced its first-ever 1:1 bonus issue in August.

Technical Outlook

SEBI-registered analyst Sameer Pande noted that Time Technoplast stock is trading above key moving averages in the short term, reinforcing a strong buy sentiment. Positive technical readings (like RSI and MACD) support bullish momentum in short-term frames. He identified strong support around the ₹470-₹440 levels.

In the medium term, the stock has recovered from May lows, breaking out from a downward channel. On the weekly timeframe, Pande highlighted a breakout on the supertrend, followed by RSI around 60.

On a monthly timeframe, he noted that the stock was showing strong momentum across most indicators. He flagged significant resistance around the ₹530-₹545 levels. A breakout above these levels can trigger a considerable upmove ahead, he concluded.

Time Technoplast is a multinational conglomerate and a leading manufacturer of polymer products for industrial packaging solutions, automotive components, healthcare products, and more.

The company recently signed a collaboration with Drone Stark Technologies to develop hydrogen-powered drones using composite hydrogen cylinders. And it has expanded operations in the Middle East with a new facility in Saudi Arabia.

What Is The Retail Mood?

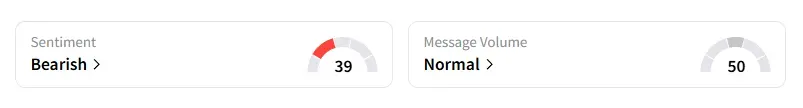

Data on Stocktwits shows that retail sentiment has been ‘bearish’ for a week on this counter.

Time Technoplast shares have declined 3% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1494564204_jpg_be6f667516.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)