Advertisement|Remove ads.

Tiptree Stock Rises Premarket As Firm Offloads Fortegra To DB Insurance For $1.65B: Retail Traders Bullish

Tiptree stock gained 2% in premarket trading on Friday after the company and other investors agreed to sell the Fortegra Group, a Tiptree unit, to South Korea’s DB Insurance for $1.65 billion.

The transaction will mark the largest U.S. market entry by a Korean non-life insurer, DB Insurance said. Warburg Pincus, which revealed a 24% stake in the U.S. specialty insurer a few years ago, has also agreed to the sale.

The deal comes about a year after Tiptree withdrew from a planned initial public offering for Fortegra, citing market conditions. On Thursday, Tiptree stock logged its worst trading session since 2021 after the Insurer first reported about the deal, which reportedly priced Fortegra twice at twice its book value.

Tiptree’s decision to proceed with the sale comes amid a resurgent IPO market in the U.S., aided by prospects of further rate cuts by the Federal Reserve and an improving regulatory environment.

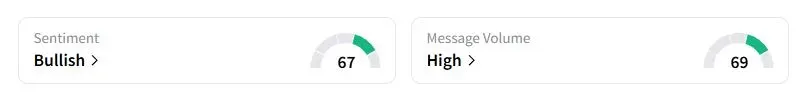

Retail sentiment on Stocktwits about Tiptree was in the ‘bullish’ territory at the time of writing.

Founded in 1978 and headquartered in Jacksonville, Florida, Fortegra operates across all 50 states in the U.S. and several countries in Europe, including the UK and Italy. The insurer had reported gross written premiums of $3.07 billion and net income of $140 million in 2024.

“The acquisition is expected to provide DB Insurance with a platform for global growth in the world’s largest property and casualty (P&C) markets, enable entry into the profitable surety and warranty sectors, and enhance earnings stability through broader geographic and business-line diversification,” the companies said in a statement.

Tiptree stock has fallen over 4% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)