Advertisement|Remove ads.

Titan’s Damas Deal Boosts Its Global Play, SEBI RA Sees Breakout Potential To ₹3,700

Titan shares rose nearly 2% on Tuesday after it announced the acquisition of a 67% stake in Damas Jewellery LLC, a premier luxury jewellery retailer based in Dubai.

Titan will invest ₹2,438 crore ($283 million) through its wholly owned subsidiary, Titan Holdings International FZCO. This deal is likely to be finalised by January 31, 2026, and Titan has the option to buy the remaining 33% stake post-December 31, 2029, based on mutually agreed terms.

SEBI-registered analyst Pradeep Carpenter highlighted the benefits of the deal and the road ahead for Titan stock. He believes that with this deal, Titan will be able to add to its market presence in the Middle East, increasing growth prospects and shareholder value in the years to come.

What The Deal Brings For Titan?

Market Expansion: Titan is well-positioned for significant growth in the Gulf Cooperation Council (GCC) countries, including the UAE, Saudi Arabia, Qatar, Oman, Kuwait, and Bahrain.

Retail Boost: It can tap into Damas’s existing network of 146 stores, which adds to its presence. Currently, Titan’s premier brand Tanishq operates 13 stores in the GCC region.

Brand Diversification: It will expand its reach beyond the South Asian diaspora market to target a new section of affluent customers.

Technical Trends

Post the announcement of this acquisition, Titan shares reversed strongly from the ₹3,350 support zone, breaking above the last 9-day high. Momentum indicators have shown an improvement, with their Relative Strength Index (RSI) rebounding to 50.

Carpenter pegged immediate resistance at ₹3,580. A breakout above this could trigger a move toward the ₹3,700 zone, where a previous price gap exists that may be filled in the near term.

On the downside, he sees immediate support at ₹3,350, which, if breached, the next crucial support would be at ₹3,200. Sustained momentum above resistance levels could attract further buying interest; however, failure to hold the uptrend may result in a retest of lower support zones, Carpenter added.

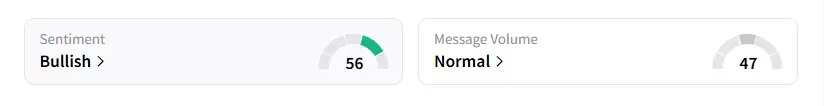

Data on Stocktwits shows retail sentiment turned ‘bullish’ a day ago on this counter.

Titan shares have risen 7% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)