Advertisement|Remove ads.

TMC Reveals $23.6B Deep-Sea Mining Potential: Retail Says Stock ‘Crazy Profitable’

The Metals Company Inc. (TMC) released two independent technical economic assessments on Monday, outlining the financial and operational prospects of its deep-sea mining initiatives in the Clarion Clipperton Zone (CCZ) of the Pacific Ocean.

Together, the reports project a combined value of $23.6 billion for the company's NORI and TOML resource areas.

The centerpiece of the announcement is a Pre-Feasibility Study (PFS) for the NORI-D Project, which presents a projected Net Present Value (NPV) of $5.5 billion and declares the first-ever Probable Mineral Reserves from a polymetallic nodule project.

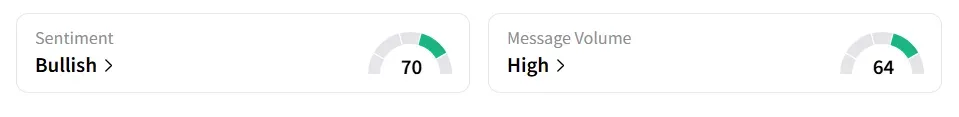

Following the release, The Metals Company stock traded over 22% in Monday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘bullish’ (70/100) territory amid ‘high’(64/100) message volume levels.

The stock experienced a 113% increase in user message count over the past 24 hours. Stocktwits users lauded the pre-feasibility study.

TMC aims to begin commercial production from the NORI-D site by the final quarter of 2027, pending regulatory approvals. At peak operation, expected from 2031 through 2043, the project is targeting an annual throughput of 10.8 million tonnes of wet nodules.

With projected cash costs of $1,065 per tonne of nickel (inclusive of byproduct credits) and All-In Sustaining Costs (AISC) at $2,569 per tonne, TMC expects to operate in the lowest production cost quartile globally.

The NORI-D Project is forecasted to maintain an average EBITDA (earnings before interest, taxes, depreciation, and amortization) margin of 43% over its 18-year life of mine.

An accompanying Initial Assessment (IA) evaluated the remaining resource base across the NORI and TOML blocks, excluding NORI-D.

The IA values the extended resource at $18.1 billion after-tax NPV, with an Internal Rate of Return (IRR) of 36%. Long-term projections from 2039 through 2058 indicate a steady EBITDA margin of 57%.

The Metals Company stock has gained over 424% in 2025 and over 505% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)