Advertisement|Remove ads.

Toll Brothers Stock In Focus Ahead of Q1 Earnings: Retail’s Extremely Bullish

Shares of luxury home builder Toll Brothers Inc. ($TOL) were in the spotlight last week following an analyst upgrade ahead of the company’s fiscal first-quarter results, with retail sentiment turning upbeat.

Toll Brothers is scheduled to report earnings on Tuesday after the bell.

Wall Street analysts expect the company to post Q1 earnings per share of $2.04 on estimated revenue of $1.91 billion, according to Stocktwits data. Toll Brothers has beaten EPS and revenue estimates four times in the past four quarters.

Last week, Seaport Research analyst Kenneth Zener upgraded Toll Brothers to ‘Neutral’ from ‘Sell,’ The Fly reported. Meanwhile, BofA reportedly lowered the price target to $156 from $165 with a ‘Buy’ rating, citing underperformance by home builder stocks in 2024 with declining demand in the second half of the year.

Last month, Toll Brothers got several unfavorable price revisions with JPMorgan analyst Michael Rehaut downgrading the company to ‘Neutral’ from ‘Overweight’ with a price target of $150, down from $166 as part of a broader review of the homebuilding sector in 2025.

The firm switched its favorable view of the past two years to a "more cautious, less constructive approach" for 2025, citing lower growth in key demand drivers for housing such as rates, employment growth, and affordability, The Fly reported.

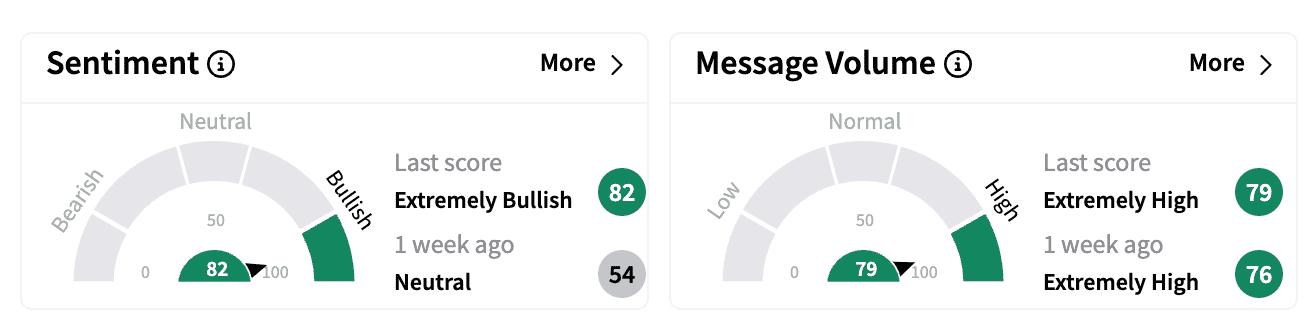

Sentiment on Stocktwits improved to ‘extremely bullish’ from ‘neutral’ a week ago. Message volume inched up in the ‘extremely high’ zone.

In its most recent quarter, Toll Brothers reported EPS at $4.63, beating consensus estimates of $4.34.

Its revenues stood at $3.33 billion, above the $3.17 consensus estimates. Its home sales revenues grew 10% compared to the previous year.

Toll Brothers stock is down 2% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219715394_jpg_c787a7b591.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_martin_shkreli_jpg_4da92d4843.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)