Advertisement|Remove ads.

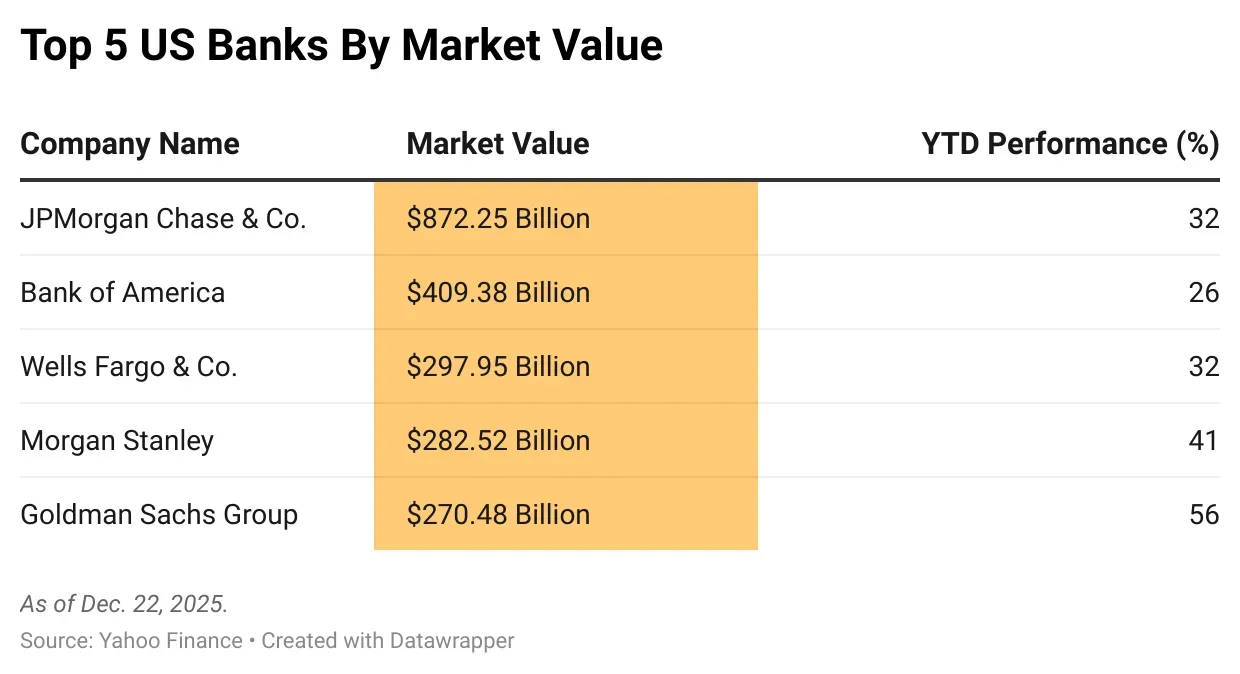

The Most Valuable US Banks: JPMorgan, Bank Of America Lead

As 2025 comes to a close, the U.S. banking sector remains at the center of global finance, dealmaking, and consumer lending. The year brought market volatility and shifting investor sentiment. Still, JPMorgan Chase, Bank of America, Wells Fargo, Morgan Stanley, and Goldman Sachs continue to dominate the finance landscape.

Across the five largest U.S. banks, 2025 was shaped by rising deal activity, competition for talent, and closer scrutiny of costs and returns. Investment banking and trading provided tailwinds, but weak consumer sentiment weighed on revenue in some sectors.

Stocktwits takes a look at the top five U.S. banks by market capitalization:

JPMorgan Chase & Co.

YTD Performance: 32.3%

Market Value: $872.25 Billion

JPMorgan Chase is the most valuable bank in the United States. The firm operates a broad platform spanning consumer and commercial banking under the Chase brand, as well as global investment banking, markets, and asset and wealth management.

In 2025, the bank continued to benefit from its scale and diversification. JPMorgan poured billions into bolstering its AI infrastructure. It also expanded its engagement with digital assets after years of skepticism. The bank unveiled its own permissioned network, a deposit-backed digital token, and also plans to allow Bitcoin and Ethereum to be used as collateral for institutional lending.

Bank of America

YTD Performance: 25.8%

Market Value: $409.38 Billion

Bank of America ranks among the world’s largest financial institutions, offering services across consumer banking, wealth management, and corporate and investment banking.

Like peers, Bank of America continued to benefit from increased dealmaking activity. At the end of the third quarter, its Global Wealth and Investment Management saw client balances climb to more than $4.6 trillion, driven by strong flows of $84 billion in the past year.

Wells Fargo & Co.

YTD Performance: 32.4%

Market Value: $297.95 Billion

Wells Fargo provides consumer and commercial banking, home lending, wealth management, and investment banking services across the U.S.

Wells Fargo continued to navigate the legacy of past regulatory issues while trying to gain ground against larger Wall Street rivals. The company managed to lift a regulatory order that capped its assets at $1.95 trillion. More than 95% of its revenue came from U.S. consumers and U.S.-based companies.

Morgan Stanley

YTD Performance: 40.8%

Market Value: $282.52 Billion

Morgan Stanley operates a global financial services platform spanning investment banking, securities trading, and wealth management.

In 2025, the firm benefited from a broader rebound in investment banking and trading across Wall Street. In the third quarter alone, Equity underwriting revenues increased 80% year over year to $652 million, driven by IPO activity. Morgan Stanley noted that themes around emerging technologies and renewed investor appetite in Asia also contributed to its strong earnings.

Goldman Sachs Group

YTD Performance: 56%

Market Value: $270.48 Billion

Goldman Sachs is a global investment bank focused on advisory, underwriting, trading, and asset and wealth management for institutional and high-net-worth clients.

Goldman reshaped its technology, media, and telecom investment banking group in 2025 to sharpen its focus on digital infrastructure and artificial intelligence-related deals. The shift reflected efforts to align its advisory business with changing client demand.

Also See: From Jets To Missiles: The Top 5 US Aerospace And Defense Firms By Market Value

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Binance_jpg_94b70a967a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2237775323_jpg_dcd1c04c15.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Alibaba_jpg_ec89d8ffa0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236894865_jpg_fc1259ad29.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)