Advertisement|Remove ads.

Top Tech Stocks With Most Retail Chatter: Bit Origin Rockets On Dogecoin Plan, Netflix Beats Q2, Inuvo Climbs

The tech-heavy NASDAQ composite Index hit a fresh high on Thursday, for a fourth straight session, driven by positive market momentum and encouraging earnings reports.

Here are the top three tech companies that saw the highest retail chatter on Stocktwits in the last 24 hours.

- Bit Origin (BTOG): The cryptocurrency mining platform saw retail chatter surge 1,066% in 24 hours after the company announced on Thursday that it had secured deals with approved investors to raise up to $400 million to launch a new Dogecoin treasury plan.

The company is planning to raise $400 million by selling Class A ordinary shares and another $100 million through convertible debt for the treasury plan.

The announcement sent Bit Origin’s stock over 90% higher on Thursday, closing at $0.63. The stock traded over 18% higher in Friday’s premarket.

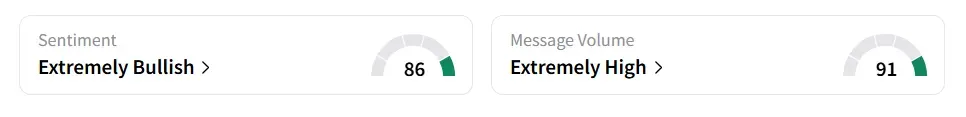

Retail sentiment around BitOrigin was ‘extremely bullish’ (86/100), with ‘extremely high’ (91/100).

Dogecoin’s price increased 11% to $0.24 in the last 24 hours.

2. Netflix Inc. (NFLX): The streaming giant saw retail chatter rise 973% in the last 24 hours, following the better-than-expected second-quarter (Q2) earnings result.

The company’s revenue grew 16% year-over-year (YoY) to $11.08 billion, exceeding the analysts' consensus estimate of $11.06 billion, according to Fiscal AI data. Adjusted earnings per share (EPS) of $7.19 also surpassed the consensus estimate of $7.09.

Netflix stock traded over 1% lower in Friday’s premarket.

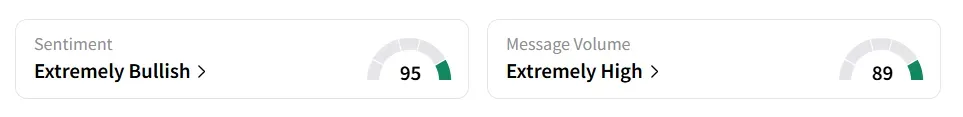

On Stocktwits, retail sentiment around Netflix hit a three-month high and was at ‘extremely bullish’(95/100) territory amid ‘extremely high’(89/100) message volume levels.

Netflix stated in a letter to its shareholders that its strong performance this quarter was driven by the launch of several popular series, such as “Squid Game Season 3,” “Sirens,” “Ginny & Georgia Season 3,” “The Eternaut,” and “Secrets We Keep.”

Netflix has increased its 2025 revenue forecast to between $44.8 billion and $45.2 billion, an upgrade from its earlier estimate of $43.5 billion to $44.5 billion.

Morgan Stanley has increased its price target for Netflix to $1,500 from $1,450 and maintained its ‘Overweight’ rating following the Q2 earnings, according to TheFly.

In a post-earnings note to investors, the research firm said that the newly implemented advertising technology could nearly double ad revenue in 2025, and Netflix’s early but expanding use of generative AI tools supports the positive outlook on the stock.

3. Inuvo Inc (INUV): The AI-based advertising technology company’s retail chatter surged 750% in the last 24 hours as the stock hit a six-month high.

Inuvo stock jumped 33% on Thursday to close at a six-month high of $5.76.

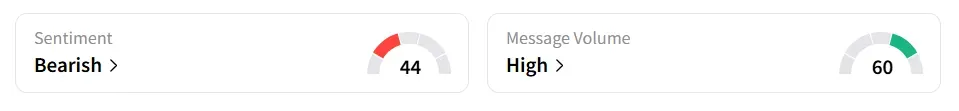

However, retail sentiment toward Inuvo was at ‘bearish’ (44/100) territory with ‘high’ (60/100) message volume levels.

On June 12, the company announced that it is sticking with its previous forecast, expecting revenue for the second quarter (Q2) to grow by at least 25% compared to the same period last year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2166957713_jpg_a9ada70a7b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227231024_jpg_227a7ced1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Bury_resized_jpg_14e6fc7c2b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ionq_resized_jpg_35563ea1fb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)