Advertisement|Remove ads.

Truist Financial Stock Moves Higher After Q4 Profit Beat: Retail Elated

Truist Financial Corp shares gained 5.6% in morning trade on Friday after it beat the market estimate for quarterly profit.

The lender reported adjusted earnings of 91 cents per share for the fourth quarter, beating the average analyst estimate of $0.88 per share, according to FinChat data.

Due to its balance sheet repositioning, its net interest income (NII) increased 1.8% to $3.64 billion compared to the year-ago quarter.

Truist said its net interest margin, a gauge of profitability, rose 12 basis points to 3.07% but was down five basis points sequentially.

Its investment banking and trading income rose 58.8% to $262 million due to higher structured real estate income and loan syndication fees.

The bank’s average deposits grew 1.5% to $390 billion during the fourth quarter, compared to the previous quarter.

Larger rivals JP Morgan, Wells Fargo, Citigroup, and Bank of America all surpassed profit estimates earlier this week.

Its quarterly provision for credit losses fell 17.7% to $471 million compared to last year. However, it rose 5% sequentially.

“Going into 2025, we have strong momentum and look forward to growing with our clients in some of the best markets in the country,” CEO Bill Rogers said in a statement.

The Charlotte, North Carolina-based company forecast a 3% to 3.5% rise in its adjusted 2025 revenue.

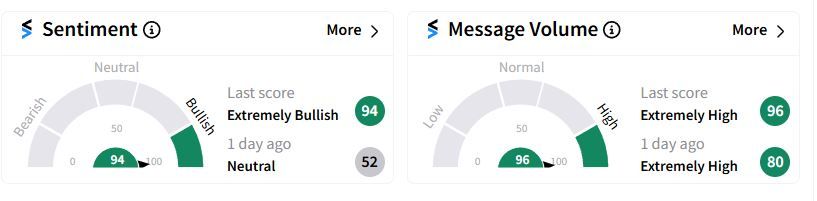

Retail sentiment on Stocktwits jumped to ‘extremely bullish’ (94/100) territory from ‘neutral’(52/100) a day ago and hit its highest in a year, while retail sentiment remained ‘extremely high.’

Users were quick to express their satisfaction with the earnings.

Over the past 12 months, the stock has gained nearly 26%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)