Advertisement|Remove ads.

DJT, NVDA, GNS Lead Retail Buzz For Stocks Ahead Of Fresh Trading Week

U.S. stock futures rose early Monday, rebounding from a volatile week marked by mixed earnings and concerns about the Federal Reserve's interest rate plans. While Wall Street looked ahead to a potential recovery, retail investors were found chatting about these three stocks the most before the opening bell:

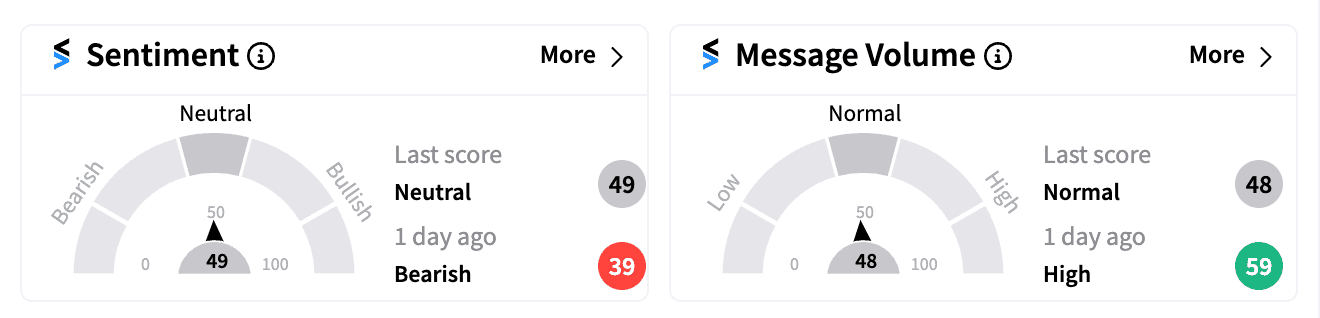

Trump Media & Technology Group Corp. (DJT): Shares of the Donald Trump-linked social media company were flat in pre-market trading. Stocktwits sentiment remained ‘neutral’ (49/100), a slight improvement from the previous day's ‘bearish’ mood (39/100).

This follows second-quarter results showing a 30% revenue decline to $836,900 and a net loss of $16.4 million. CEO Devin Nunes outlined plans for a Truth+ streaming service and potential mergers or acquisitions.

However, the stock is up over 50% year-to-date, fueled by optimism around Trump's involvement and potential reelection.

Nvidia Corp. (NVDA): The AI-chipmaker is generating increased retail interest ahead of its Q2 earnings report. Shares were recovering pre-market after Friday's decline, partly due to concerns following AMD's weak results.

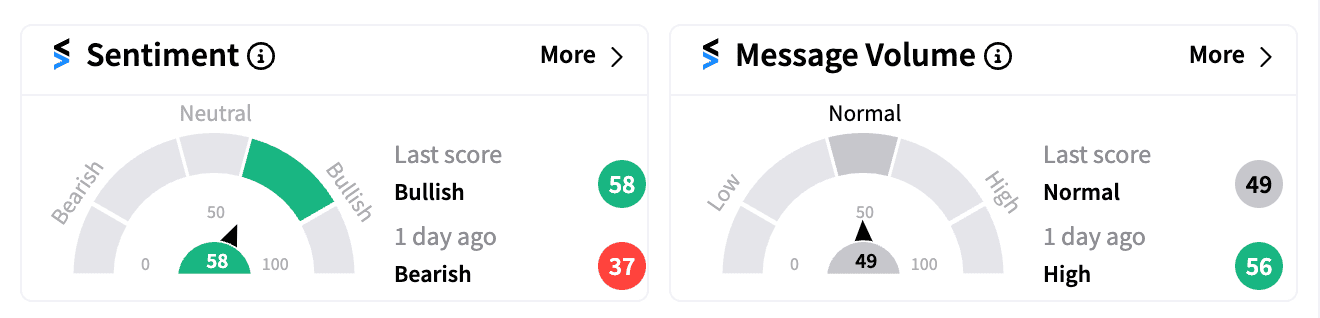

Stocktwits sentiment improved from ‘bearish’ to ‘bullish’ (58/100). Analyst Dan Ives predicts a significant earnings report, due after market hours on August 28, saying it would be a "drop the mic moment" for AI.

Last week, New Street upgraded NVDA to ‘Buy’ from ‘Neutral,’ citing a healthy correction and opportunity for exposure.

Genius Group (GNS): Shares of the AI-powered educational tech platform surged over 19% pre-market, continuing the momentum from Friday's announcement of a share buyback by founder and CEO Roger James Hamilton.

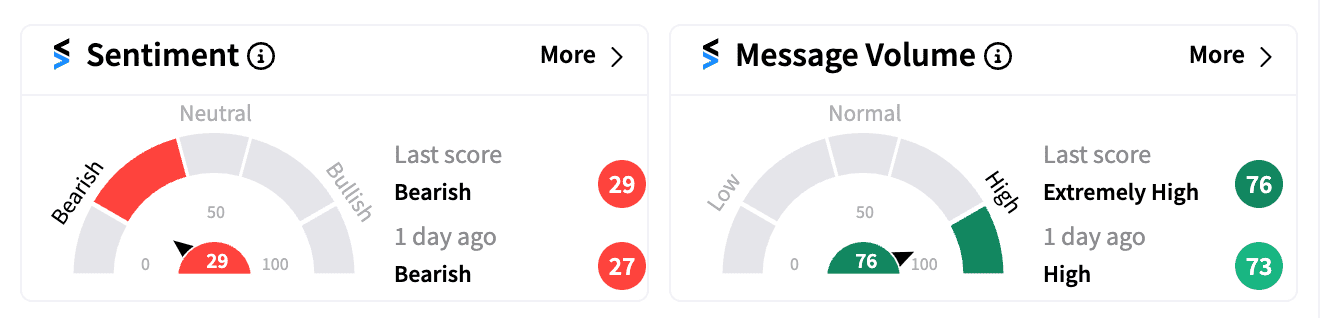

However, Stocktwits sentiment remained ‘bearish’ (29/100) as it did a day earlier, but message volume surged to ‘extremely high’ levels.

The company, last week, said it has implemented a 1-for-10 reverse stock split to meet NYSE listing requirements. Despite a 27% revenue increase in 2023 and a $105 million revenue target for this year, the stock has lost over 78% of its value this year.

/filters:format(webp)https://images.cnbctv18.com/uploads/2021/08/Bandhan-bank-e1642766302761.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/08/2025-08-05t045421z-1959791813-rc26kda2b3it-rtrmadp-3-indusind-bank-stocks-2025-08-68f6aea16b508e51a6b3547f6d7ae2a1.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/07/tata-group-2025-07-65ccfee43b311b2001c68dd4eec5ebb4.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/01/punjab-and-sind-bank-2025-01-290e425e7cf52948e354f0d979be7e46.jpeg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/02/bajaj-healthcare-2025-02-2900ffc2661ddb245f215ddcbe0c3b6f.jpeg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/12/uco-bank.jpg)