Advertisement|Remove ads.

Tesla Receives Wall Street’s Highest Price Target of $550, But Retail Sentiment Remains Shaky Amid Weakness

Tesla Inc.’s shares dropped over 1% in volatile trading on Wednesday, heading for another day in the red, despite a bullish price target boost from Wedbush Securities.

Analysts led by Dan Ives raised their price target for Tesla from $515 to $550, citing growing confidence in the company’s 2025 demand and its accelerated push towards an autonomous future under the Trump administration.

Wedbush’s $550 target is now the highest on Wall Street, implying a 30% upside from current levels and a 35x multiple on long-term earnings.

Ives emphasized that a Trump White House would be a “total game changer” for Tesla’s AI and autonomous vehicles, with expectations that regulatory hurdles for Full Self-Driving (FSD) would clear under a more favorable administration.

Ives also raised his bull case target to $650, noting that Tesla could achieve a $2 trillion market cap by the end of 2025 as its autonomous technologies, including the Cybercab, begin to take shape.

The analyst sees Tesla’s AI opportunity alone worth at least $1 trillion.

“We believe Tesla remains the most undervalued AI player in the market today,” Ives stated, emphasizing the company’s evolving role as more than just a car maker but a disruptive tech player.

The analyst also noted that FSD penetration could surpass 50%, drastically improving Tesla’s financial model and margins.

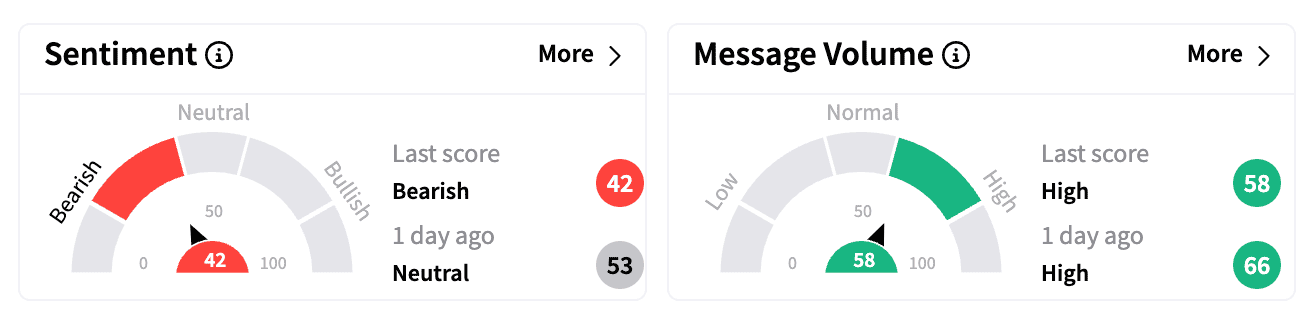

Despite this bullish outlook, retail sentiment on Tesla dipped into ‘bearish’ territory on Stocktwits on Wednesday afternoon amid high message volume.

Several users expressed concerns about CEO Elon Musk’s increasing involvement in politics, which could potentially distract from Tesla’s operations.

Others voiced worries that Trump’s anti-EV stance, including the removal of tax rebates and carbon credits, could hurt Tesla’s revenue.

Tesla’s absence from the $500 billion “Stargate” AI project, which Trump billed as the largest AI infrastructure initiative in U.S. history, was also mentioned.

Some users questioned Tesla’s overvaluation, as the stock currently trades at a forward earnings multiple of 135.3x and a trailing multiple of 115x, according to Koyfin data.

The EV giant will release its fourth-quarter results next Wednesday. Wall Street estimates adjusted earnings per share of $0.76 on revenue of $27.11 billion.

Tesla's stock has nearly doubled over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tom_Lee_BMNR_64157a5786.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tech_stocks_jpg_78bcc9c52f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2169625480_jpg_988055282a.webp)