Advertisement|Remove ads.

Wall Street Mostly Buys Into Tesla’s ‘Supercharged’ Autonomy Hype, But Retail Traders Can’t Overlook Q4 Stumble

Shares of Tesla, Inc. rose over 2% in premarket trading Thursday, recovering from a post-earnings dip after CEO Elon Musk shifted the narrative from a weak fourth quarter to a future dominated by autonomy, artificial intelligence, and humanoid robots.

Tesla missed fourth-quarter (Q4) earnings and revenue estimates, with adjusted earnings per share (EPS) of $0.73 versus an expected $0.77 and revenue of $25.71 billion against an estimated $27.13 billion.

This capped off a year of missing both delivery and earnings targets.

While the stock initially fell after hours, Musk’s commentary on Tesla’s AI and robotics ambitions reignited optimism.

He said 2026 would be “epic” and 2027-2028 “ridiculously good,” claiming Tesla could become the world’s most valuable company.

He also touted Full Self-Driving (FSD) as the “largest value increase in human history” and projected Tesla would be producing “hundreds of millions” of Optimus humanoid robots annually within a few years.

Wall Street analysts took note of the comments, with several finding it favorable for the stock.

Barclays, while acknowledging Tesla’s worst auto gross margin in seven years, said Musk’s vision overshadowed weak Q4 numbers.

“The takeaway is - who cares about estimates when Tesla is providing you supercharged narrative command,” the analyst added, retaining an ‘equal weight’ rating and $325 price target.

Mizuho reiterated an ‘Outperform’ rating with a $515 price target, citing Tesla’s dominance in U.S. EVs and potential for long-term growth via Cybercab and Optimus.

Wells Fargo raised its target to $135 from $125, saying Musk’s “razzle-dazzle” promises took center stage yet again. However, it added that “downside risk is high if things fall apart.”

JPMorgan was even more skeptical, arguing the post-earnings rally “bore no relation whatsoever” to Tesla’s fundamentals. The brokerage maintained an ‘Underweight’ rating with a $135 target, highlighting the stock’s extreme valuation disconnect.

Tesla trades at a forward P/E of 125.1x and a trailing P/E of 106.7x, and about 17% above analysts’ average target.

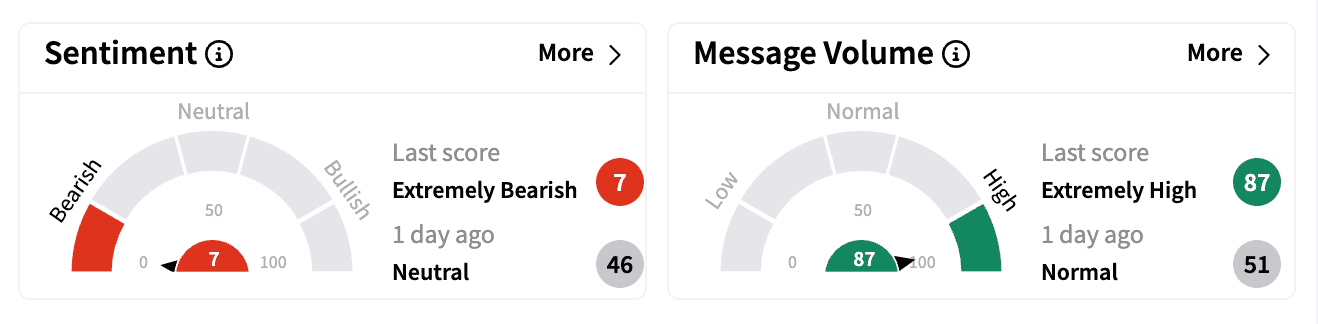

Meanwhile, retail sentiment for Tesla on Stocktwits turned ‘extremely bearish’ ahead of Thursday’s session.

Skeptical users questioned the company’s current valuation, Musk’s bold projections and even noted the company’s Q4 operating profit was propped up by Bitcoin gains.

Tesla’s finance chief also acknowledged headwinds, including potential 25% Trump tariffs on Mexico and Canada, expected higher 2025 operating expenses, and margin pressure from a new Model Y.

Tesla’s stock has nearly doubled in the past year, fueled mainly by optimism surrounding Donald Trump’s election win and Musk’s influence in the administration, which many believe could lead to favorable regulatory changes.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_original_jpg_285085becb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262712431_1_jpg_6f471d2542.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259503553_jpg_13fb8f2e88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)