Advertisement|Remove ads.

Tesla Stock Heads For Worst Day In Nearly A Month On Trump Tariff Anxiety, Retail Braces For Pain

Shares of Tesla, Inc. tumbled nearly 6% on Monday afternoon amid a broader market selloff sparked by uncertainty over President Donald Trump’s shifting stance on tariffs.

U.S. stocks partially rebounded as investors tried to parse Trump’s evolving plans for sweeping trade restrictions on key partners. After a call with Mexican President Claudia Sheinbaum, Trump agreed to delay tariffs on Mexico by a month.

While Tesla assembles all its U.S.-market vehicles domestically, its supply chain remains exposed.

According to a Barron’s report, about 15% of the parts in a Model Y sold in the U.S. come from Mexico. Canadian-made components are also involved, though their share is difficult to quantify.

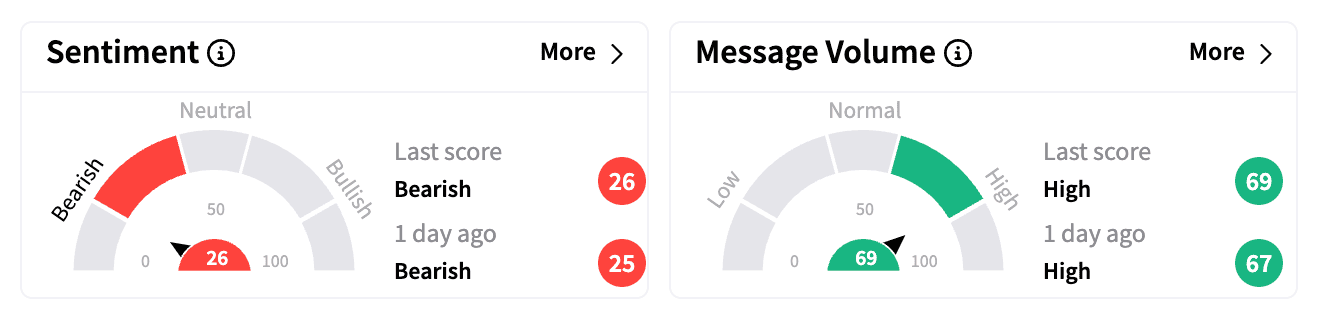

On Stocktwits, sentiment remained ‘bearish’ with ‘high’ message volume, suggesting growing retail anxiety over Tesla’s exposure to Trump’s trade policies.

Some users voiced frustration over CEO Elon Musk’s involvement in multiple ventures — including his role in Trump’s administration — arguing that it distracted him from Tesla.

Others pointed to weakening sales in key markets such as Europe and China.

Tesla stock has faced pressure since missing fourth-quarter revenue estimates, but Musk’s pledge to expand beyond EVs — touting growth in autonomous driving and AI robotics — briefly revived investor optimism.

However, Monday’s steep drop suggests those hopes have also been overshadowed by Trump’s renewed push to roll back pro-EV policies set by his predecessor, Joe Biden.

Tesla stock trades at a 12-month trailing price-to-earnings (P/E) ratio of 188x and a forward multiple of 128x, currently sitting about 15% above Wall Street’s average price target of $325, according to Koyfin data.

Shares have more than doubled over the past year but are down 1.7% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Black_Rock_Bitcoin_ETF_IBIT_f66b744bfc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kraken_2091850a33.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215666275_jpg_07d03239b9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_2_jpg_a7bbca2bde.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)