Advertisement|Remove ads.

Tyson Foods Stock Get A Boost With Strong Q1 Earnings, Rising Chicken Demand From Diet-Focused Consumers: Retail Sentiment Brightens

Shares of meat products company Tyson Foods Inc. ($TSN) rose more than 2% on Monday after the company beat estimates for its first quarter, lifting retail sentiment.

Strong demand for beef and chicken helped Tyson Foods post a revenue rise of 2.3% to $13.62 billion, beating expectations of $13.46 quoted by Wall Street analysts. Earnings per share came in at $1.14, above the $0.90 expected by analysts, according to Stocktwits data.

“Fiscal year 2025 is off to a strong start, as we delivered our third consecutive quarter of year-over-year growth in sales, operating income, and EPS," Donnie King, president & CEO of Tyson Foods. "Our best quarterly performance in more than two years reflects improved execution across the business, including exceptional results in chicken. Consumers remain focused on adding protein to their diets, and our diversified multi-channel, multi-protein portfolio ensures we are well-positioned to meet this demand while reinforcing our leadership as a world-class food company."

For fiscal 2025, Tyson expects sales to be flat to up 1% in fiscal 2025 as compared to fiscal 2024.

Segment-wise, it projects chicken production will increase about 2% in fiscal 2025 as compared to fiscal 2024, with adjusted operating income of $1.0 billion to $1.3 billion for fiscal 2025.For the pork segment, it projects domestic production will increase by about 2% in fiscal 2025 as compared to fiscal 2024, with adjusted operating income of $0.1 billion to $0.2 billion in fiscal 2025.

Tyson reportedly factored in tariff risks for its annual adjusted operating income forecast range of $1.9 billion and $2.3 billion, from $1.8 billion to $2.2 billion from earlier. Tyson could be subject to tariff risks and ongoing supply issues for U.S. cattle, Reuters reported. On Monday, Trump put a one-month pause on proposed tariffs with Mexico.

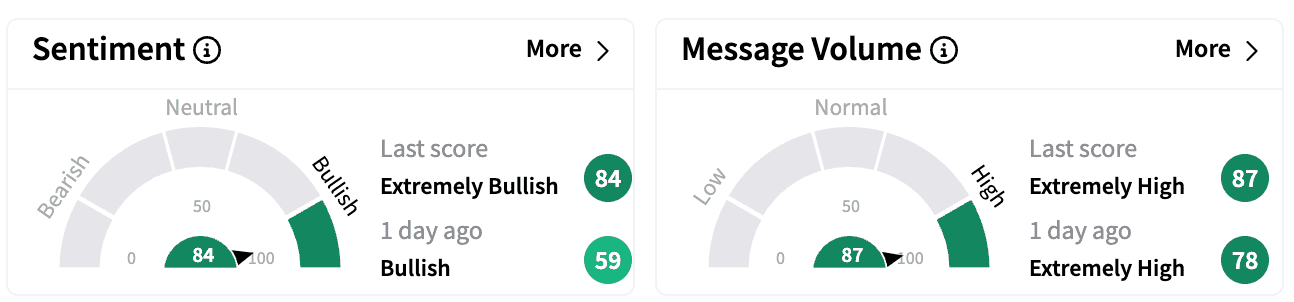

Sentiment on Stocktwits improved to ‘extremely bullish’ from ‘bullish’ a day ago. Message volumes continued to be in the ‘extremely high’ zone.

Piper Sandler upgraded Tyson to ‘Neutral’ from ‘Underweight’ with a price target of $58, which was unchanged’ based on its view that the stock is at "around fair value," Fly.com reported.

Tyson Foods brands include Tyson, Jimmy Dean, Ball Park, Aidells and ibp.

Tyson Foods stock is up 0.5% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2237640344_jpg_bc97a7240c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2245685477_jpg_ce08eb96cb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2215875671_jpg_b63edc641f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_hassett_jpg_1eb8c227c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229940320_jpg_5bc20a70df.webp)