Advertisement|Remove ads.

UniQure Narrows Q1 Loss But Revenue Plummets: Retail’s In Wait-And-Watch Mode

Shares of uniQure N.V. (QURE) were in the spotlight on Friday morning after its first quarter (Q1) revenue fell 81% year-on-year (YoY) while losses narrowed.

The gene therapy company reported revenue for the three months ended March of $1.6 million, compared to $8.5 million in the same period of 2024, and below an analyst estimate of $6.71 million, as per Finchat data.

The company attributed the revenue fall to a decrease of $4 million in contract manufacturing of HEMGENIX gene therapy for biotherapeutics company CSL Behring, among other factors.

uniQure, however, narrowed its quarterly loss to $0.82 per share, compared to a loss of $1.36 in the corresponding period of 2024. Analysts were estimating a loss of $1.06 per share.

The narrowing of the net loss in the quarter was driven by a significant reduction in the company’s operating expenses, as it slashed employee-related expenses, facility expenses, and costs related to preclinical supplies.

The firm ended the quarter with cash, cash equivalents, and current investment securities of approximately $409 million, expected to fund its operations into the second half of 2027.

The company is now seeking U.S. FDA approval for its AMT-130 gene therapy as a treatment for Huntington’s disease.

CEO Matt Kapusta said that the company expects to provide a regulatory update on AMT-130 in the second quarter, including guidance on the potential timing for its application to the FDA seeking approval to distribute the therapy.

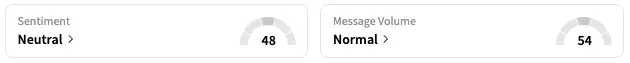

On Stocktwits, retail sentiment around uniQure remained unmoved within the ‘neutral’ territory over the past 24 hours while message volume remained at ‘normal’ levels.

QURE stock declined by 32% this year but is up by about 142% over the past 12 months.

Also See: AstraZeneca Reports Positive Data From Cancer Drug Trial: Retail Sentiment Brightens

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)