Advertisement|Remove ads.

United Airlines Brings Cheer With Q1 Profit, 2 Annual Profit Scenarios: Retail Investors Turn More Optimistic

United Airlines Holdings, Inc.'s (UAL) strong quarterly results and prudent outlook on Tuesday lifted its shares and retail sentiment among Stocktwits users.

The American carrier's earnings report showed that demand trends are stable but could deteriorate later in the year due to macroeconomic headwinds, including the impact of Donald Trump's trade tariffs.

United said it would reduce its number of flights and aircraft in anticipation of lower travel demand and a potentially weaker U.S. economy.

Investors, however, cheered the company's swing back to profitability.

Shares rose 6% in after-hours trading, and United was among the 10 top trending tickers on Stocktwits as of late Tuesday. Shares ended up 2% in the regular session.

United said profit was $387 million for the three months ended March 31, compared with a $124 million loss a year ago. On an adjusted basis, earnings of $0.91 per share beat analysts' expectations of $0.74 from FactSet.

Revenue rose 5.4% to $13.21 billion, slightly below the target of $13.23 billion.

The airline issued two versions of its full-year adjusted earnings per share forecast. The first maintained its prior range of $11.50 to $13.50. The second, reflecting a potential U.S. recession scenario was revised downward to between $7 and $9.

"The Company's outlook is dependent on the macro environment which the Company believes is impossible to predict this year with any degree of confidence," United said in an investor update.

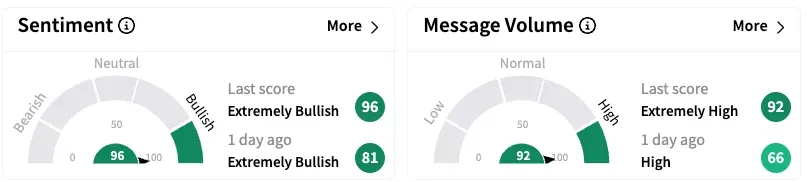

On Stocktwits, retail sentiment climbed higher in the 'extremely bullish' territory, and message volume jumped from 'high' to 'extremely high' from a day prior.

Several users expect the stock to rise as high as $100.

However, one watcher said the two guidance sets do not necessarily instill confidence.

United also said it would cut four percentage points of its planned domestic capacity beginning in the third quarter of 2025 and tweak fleet utilization, including scaling back operations on days with lower demand.

These changes come in addition to plans to retire 21 aircraft ahead of schedule.

As of their last close, United shares have lost 31% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2166123192_jpg_1bb818cd90.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Civic_resized_jpg_120d89cac4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Opendoor_Technologies_jpg_177252e1f8.webp)