Advertisement|Remove ads.

Another California Refinery To Shut? Valero Eyes Options For Benicia Project After Flagging $1B Impairment Charge

Refiner Valero Energy (VLO) said on Wednesday it intends to idle, restructure, or cease refining operations at its Benicia refinery in California by the end of April 2026.

The company said it has notified the California Energy Commission about its current intent and is looking at strategic alternatives for its remaining operations in California.

“We understand the impact that this may have on our employees, business partners, and community, and will continue to work with them through this period,” CEO Lane Riggs said.

Valero said a pre-tax impairment charge of $1.1 billion was recorded for the company’s Benicia and Wilmington refineries during the first quarter.

The Benicia refinery has a refining capacity of 145,000 barrels per day, about 8.9% of the state’s total fuel generation capacity.

Under Democratic Governor Gavin Newsom, California has imposed some of the country's strictest compliance rules for refineries, after blaming operators of ‘price gouging.’

The state has one of the highest gasoline prices due to higher refining and crude oil costs.

Last year, California passed new regulations that required refineries to keep an emergency reserve of fuel to ease supply pressures during shortages.

Rival Phillips 66 is scheduled to shut its Wilmington refinery in Los Angeles in the fourth quarter of 2025.

If both the refineries are shut, the state could lose nearly 18% of its crude oil refining capacity.

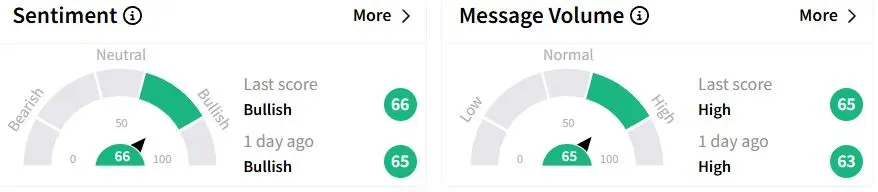

Retail sentiment on Stocktwits was in the ‘bullish’ (66/100) territory, while retail chatter was ‘high.'

Valero shares have fallen 13.1% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tandem_diabetes_resized_jpg_5f199c73c6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_82880353_jpg_0f9b1c5046.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228107699_jpg_f433126e50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_applovin_OG_jpg_12b141cd06.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robinhood_jpg_ffd49b668a.webp)