Advertisement|Remove ads.

VF Corp CFO Sees Incremental Tariff Impact Come Down To $100M To $120M, Retail Bulls Stay The Course

VF Corp. (VFC) CFO Paul Vogel said on Wednesday that the sportswear maker expects the incremental annualized tariff impact to be between $100 million and $120 million, down from its prior estimate of $150 million as it navigates U.S. President Donald Trump’s levies on global trading partners.

Vogel added that this brings the total annualized amount to $250 million to $270 million. “We expect 50% of this total to flow through in fiscal 2026 based on the timing of the expected tariff increases,” he said during a post-earnings call.

The company has actions in place to mitigate the tariff impact through sourcing savings and pricing actions that will take effect later this year.

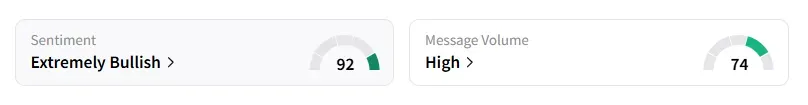

Retail user message count on Stocktwits for VF Corp jumped 120% in the last 24 hours. Retail sentiment on the stock remained unchanged in the ‘extremely bullish’ territory, with ‘high’ chatter levels, according to Stocktwits data.

Shares of VF Corp jumped nearly 12% in early trading. It has fallen over 35% year-to-date.

VF Corp, like Nike and other sportswear makers, relies heavily on Asian countries for manufacturing its products. According to the company’s fiscal 2025 report, about 85% of products purchased for sale in the U.S. are sourced through Southeast Asia and Central and South America, with Vietnam, Bangladesh, Cambodia, and Indonesia comprising the top four sourcing markets.

Less than 2% of total U.S. products are sourced through China, VF Corp noted.

“We expect a negative net impact to the gross profit of $60 million to $70 million due to tariffs in fiscal 2026. We remain confident we will be able to fully mitigate all currently anticipated tariffs in fiscal 2027,” Vogel said.

VF’s first-quarter revenue came in at $1.76 billion, compared to $1.70 billion estimated by Wall Street, according to data from Fiscal AI. Its adjusted loss for the quarter was $0.24 per share, compared with expectations of $0.33.

CEO Bracken Darrell said new products are on the way, and recent supply chain improvements are helping the firm bring them to market faster.

At the same time, the company is focused on boosting availability and variety in most in-demand items, including the Super Lowpro and its flagship OTW collection, he added.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Starbucks Sparks 1,000% Rise In Retail Chatter As CEO Niccol Touts Store Makeover And Brand Reset

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump2_jpg_ad63f384b5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_GE_Aerospace_resized_1_jpg_03f4fd7e4e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260447662_jpg_cd246b74f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2254924116_jpg_d54ffea07e.webp)