Advertisement|Remove ads.

Vishal Mega Mart Dips On Promoter Sell-Off: SEBI RA Sees Upside With Caution

Vishal Mega Mart shares fell 4% on Tuesday after a major block deal by its promoter entity, Samayat Services LLP.

Samayat Services LLP, backed by Partners Group and Kedaara Capital, offloaded around 20% equity via a ₹10,000–10,500 crore block deal, reducing promoter holding from 74.5% to around 55–60%.

According to SEBI-registered analyst A&Y Market Research, the deal, which occurred shortly after the pre-IPO lock-in period ended, points to a strategic exit by private equity investors.

While promoters continue to hold a controlling stake, it signals a notable shift in the company’s ownership structure.

They add that Vishal Mega Mart has moved higher on strong volumes after successfully retesting the ₹114 support level, signaling bullish momentum. The stock continued to trend higher, confirming buyer strength above ₹115.

A&Y Market Research has set mid-long-term targets for the stock at ₹133, ₹140, and ₹146, while suggesting placing a stop-loss at ₹113.

Vishal Mega Mart delivered a solid operational performance in FY25, driven by aggressive expansion and healthy consumer demand.

Financially, the company saw robust growth in Q4 FY25, with revenues rising 23% year-on-year and net profit surging 88%.

The company added 85 new stores during the year—including 28 in Q4 alone—bringing its total store count to 696 across 458 cities.

Same-store sales growth was equally impressive, coming in at around 13.4% for Q4 and 11.8% for the whole year.

Return metrics also remain healthy, with return on capital employed (ROCE) exceeding 11% and return on equity (ROE) around 8%, they said.

However, stretched valuations remain a concern, according to them. The stock trades at a high 92x price-to-earnings (P/E) ratio and 9x price-to-book (P/B) ratio, leaving limited room for error.

Additionally, past margin volatility, especially in FY24, could be a red flag for risk-averse investors.

They urged traders to monitor the company’s FII/DII activity, promoter reinvestment cues, and broader sentiment.

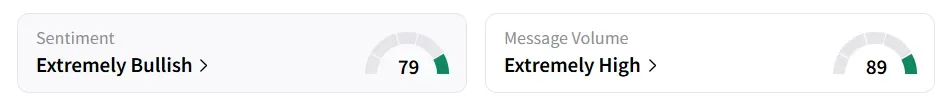

Data on Stocktwits shows retail sentiment turned ‘extremely bullish’ amid ‘extremely high’ message volumes.

Vishal Mega Mart shares have risen 13% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1232171389_jpg_55d81c88fb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_jpg_b7abd92483.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244602965_jpg_cba2d012d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novaxovid_novavax_resized_jpg_3a4b0527ae.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ripple_OG_jpg_e47a5108f1.webp)