Advertisement|Remove ads.

Walgreens Boots Alliance Confirms $10B Go-Private Deal: Retail’s Extremely Bullish

Shares of Walgreens Boots Alliance Inc. rose nearly 6% in after-hours trading on Thursday after the pharmacy chain confirmed a $10 billion take-private deal by Sycamore Partners, with retail investors cheering the move.

Under the terms, Walgreens shareholders will receive $11.45 per share one non-transferable right to receive up to $3.00 in cash from the future monetization of WBA’s interests in VillageMD, which includes the Village Medical, Summit Health and CityMD businesses.

The $11.45 offer represents an 8% premium to Walgreens' closing price Thursday and 29% on Dec. 9, 2024, the day before the first media reports regarding a potential transaction emerged.

The total value of the transaction could go up to $23.7 billion including debt and other potential future payments, said Walgreens.

Walgreens, once valued above $90 billion, has seen its stock steadily fall over the last decade due to competition from online pharmacies and other big-box retailers.

The transaction agreement has an initial “go-shop” period of 35 days, during which the company will be open to considering alternative proposals.

“While we are making progress against our ambitious turnaround strategy, meaningful value creation will take time, focus and change that is better managed as a private company,” said Tim Wentworth, CEO of Walgreens.

“Sycamore will provide us with the expertise and experience of a partner with a strong track record of successful retail turnarounds. The WBA Board considered all these factors in evaluating this transaction, and we believe this agreement provides shareholders premium cash value, with the ability to benefit from additional value creation going forward from monetization of the VillageMD businesses.”

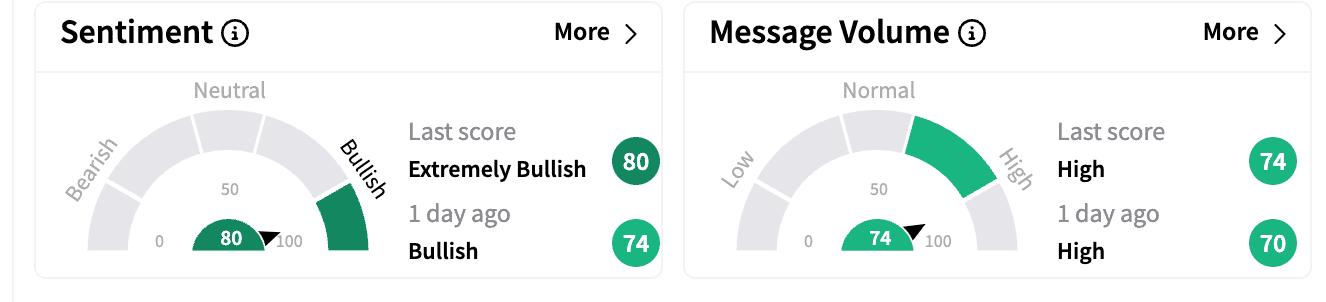

Sentiment on Stocktwits improved to ‘extremely bullish’ from ‘bullish’ a day ago. Message volume was in the ‘high’ zone.

One bullish commenter thought the best case scenario was still a better offer, but the worst case is holding onto the shares

Another suggested it should remain at $11 minimum and there was room for more money to be made should a higher offer come through.

The company will continue to operate under Walgreens, Boots and its portfolio of consumer brands, with its headquarters in Chicago.

Walgreens employs 311,000 people in eight countries and has 12,500+ stores in the U.S., Europe, and Latin America.

The company's brands include Walgreens, Boots, Duane Reade, No7 Beauty Company, and Benavides.

Its stock is up 13.6% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_e90331e6a6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2210921290_jpg_46bb1e6211.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_figma_original_jpg_90603f536b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213245133_jpg_7b8ad24799.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Carvana_jpg_86121a5fd5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1234770702_jpg_792acca270.webp)