Advertisement|Remove ads.

Walgreens Stock Jumps After-Hours On Report Of $10B Buyout By Sycamore, Retail Feverishly Weighs Fair Price

Walgreens Boots Alliance (WBA) shares jumped over 5% in after-hours trading on Monday following a Wall Street Journal report that private equity firm Sycamore Partners is nearing a $10 billion buyout of the healthcare and retail pharmacy chain.

The report claimed that Sycamore aims to finalize the deal by Thursday, offering between $11.30 and $11.40 per share in cash. The transaction may also include contingent value rights (CVRs), potentially increasing the payout if specific targets are met.

The report follows recent speculation that the go-private deal was "likely dead," as analysts and media outlets have suggested.

However, Deutsche Bank recently downgraded Walgreens to 'Sell' from 'Hold,' citing challenges of a potential buyout, terming it a “take-under" and lowering its price target from $11 to $9.

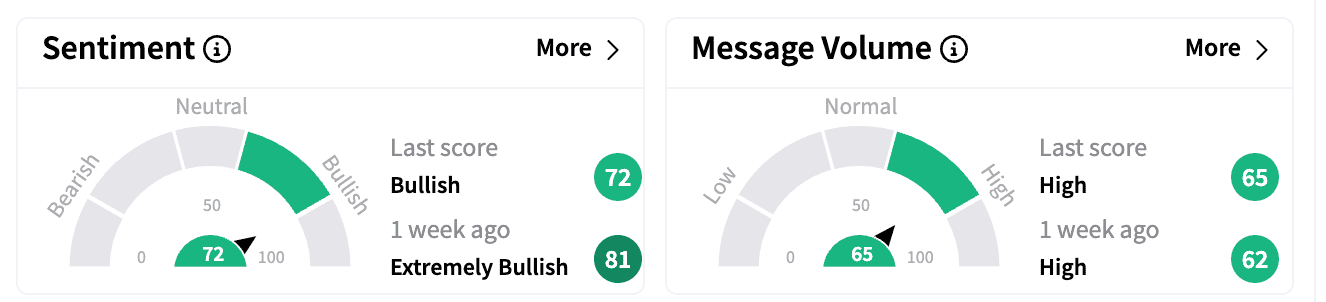

Retail sentiment on Stocktwits for WBA ended on a 'bullish' note on Monday, though it had softened from 'extremely bullish' a week ago amid an uptick in message volume.

Posts on the Stocktwits platform from Monday indicate that retail investors expecting more out of the reported deal.

One watcher said the WSJ report was "potentially flawed" as their prices do not seem to consider Executive Chair Stefano Pessina "rolling his shares into Boots," arguing that would "put the buyout price at $14 per share."

Another suggested there would be several institutional investors who would consider the rumored offer too low. "There isn't a shot in hell they take this private for 11.30 pps," they added.

Walgreens reportedly is continuing its turnaround efforts amid ongoing buyout talks. CEO Tim Wentworth and Pessina described 2025 as a "rebasing year," emphasizing that the company is still in the early stages of its recovery.

The pharmacy chain also recently settled a lawsuit with Everly Health Solutions for $595 million, related to COVID-19 test ordering and oversight. Some retail watchers believe the move helps clear legal hurdles ahead of a potential buyout.

Walgreens employs 312,000 people in eight countries and has 12,500+ stores in the U.S., Europe, and Latin America.

The company's brands include Walgreens, Boots, Duane Reade, No7 Beauty Company, and Benavides.

Its stock is up 18.3% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)