Advertisement|Remove ads.

Wall Street Boosts Hewlett-Packard Price Targets After Upbeat Q2: Retail’s Exuberant As Market Optimism Surges

Wall Street analysts raised their price targets on Hewlett-Packard Enterprise. (HPE) following a better-than-expected second-quarter (Q2) earnings.

The information technology giant’s Q2 revenue grew 6% year-on-year (YoY) to $7.6 billion, beating the consensus estimate of $7.49 billion, as per Finchat data.

The adjusted earnings per share (EPS) of $0.38 surpassed an estimate of $0.33.

Barclays analyst Tim Long increased the price target on HP Enterprise to $24 from $20, maintaining an ‘Overweight’ rating on the stock, as per TheFly.

In a note to investors, Long noted the company delivered stronger-than-anticipated results following two difficult quarters.

He highlighted that revenue from HP's AI systems exceeded expectations, and projected that profit margins are likely to improve in the second half of the year as the firm addresses previous execution challenges and controls expenses more effectively.

Wells Fargo analyst Aaron Rakers raised the price target to $20 from $17 while maintaining an ‘Equal Weight’ rating.

The adjustment follows stronger-than-expected Q2 performance and a more refined FY25 outlook, the research firm noted.

UBS increased its price target to $18 from $16 while maintaining a ‘Neutral’ rating.

In a note to investors, the firm said the company appears to have moved beyond its lowest point, but still has significant challenges ahead amid ongoing macroeconomic uncertainty.

Raymond James lifted its price target to $26 from $23 while reiterating a ‘Strong Buy’ rating.

In a note to investors, the research firm said the company delivered a solid Q2 performance, exceeding expectations and raising guidance, as it focuses on profitability, especially within the AI segment, setting itself apart from key rivals.

Raymond James described the approach as “smart” and believes the company is “headed in the right direction.”

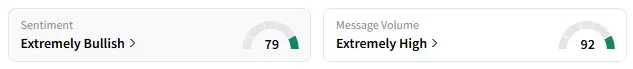

On Stocktwits, retail sentiment around Hewlett-Packard changed to ‘extremely bullish’ from ‘neutral’ the previous day.

A bullish Stocktwits user questioned the low price targets on the stock.

Hewlett-Packard stock has lost over 16% year-to-date and gained over 1% in the last 12 months.

Also See: Brookfield Commits $10B To Sweden’s AI Expansion: Retail Sees No Reason To Cheer

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_es6_jpg_b768981c5a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228901180_jpg_0c2cc7dc28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1232171389_jpg_55d81c88fb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_jpg_b7abd92483.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)