Advertisement|Remove ads.

Wayfair Plans Germany Exit, Job Cuts: Retail Sentiment Improves

Shares of the U.S.-based company rose on Friday as furniture retailer Wayfair ($W) announced it will lay off 730 people as part of its plans to exit operations in Germany and focus on core business, lifting retail sentiment.

The job cuts amount to about 3% of its global workforce, according to media reports.

According to a Reuters report, Wayfair has been struggling with sluggish demand from price-sensitive consumers.

The company will likely book $102 million to $111 million in charges made up of employee-related costs and non-cash charges during the process of closing down fasciitis and operations, added the report.

“Scaling our market share and improving our unit economics in the German market has proven challenging due to factors such as the weak macroeconomic conditions for our category in Germany, the lower maturity of our offering, our current brand awareness, and our limited scale,” founder and CEO Niraj Shah reportedly said in an employee memo, CNBC reported.

Wayfair had been operating in Germany for 15 years, but it made up a “low single digit percentage” of Wayfair’s revenue, customers and orders, Gulliver told CBNC.

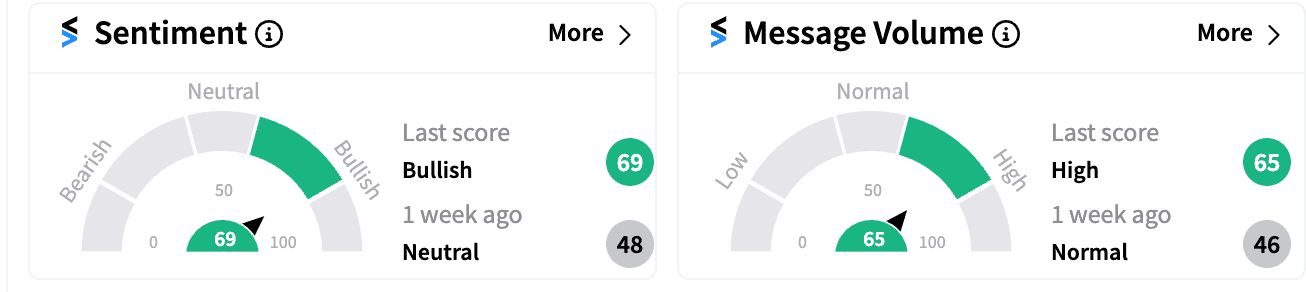

Sentiment on the Stockwits was ‘bullish’ compared to ‘neutral’ a week ago. Message volumes improved to ‘high’ category.

Boston-based Wayfair reported earnings per share of $0.22 in its most recent quarter, beating estimates by 64.8%, according to Stocktwits data.

Wayfair stock is down 4.87% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_berkshire_hathaway_jpg_86250c27d6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229072591_jpg_18a80f859a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227931369_jpg_250f28d52d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2253201649_jpg_ff6c9e331b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232102203_jpg_175efe6ca4.webp)