Advertisement|Remove ads.

Wells Fargo Vouches For Microsoft Cloud Growth With $675 Price Target On Stock

Microsoft Corp. (MSFT) received a vote of confidence from Wells Fargo, which increased its price target on the stock to $675, from a prior $650, while maintaining an ‘Overweight’ rating.

The move reflects rising confidence in Microsoft’s growth prospects, particularly in its cloud and AI operations, according to TheFly. The firm noted that the critical question through the first quarter is how much strength lies in Azure, given incremental capacity additions. With recent signs of growing demand, Wells Fargo expects Microsoft to benefit broadly from this cycle.

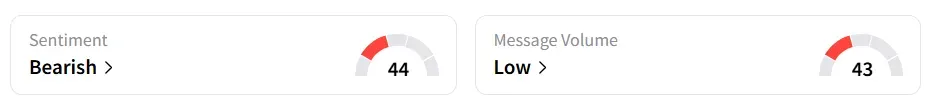

Microsoft stock traded over 1% higher on Monday afternoon. On Stocktwits, retail sentiment around the stock remained in ‘bearish’ territory with ‘low’ message volume levels.

The stock experienced a 66% increase in user message count as of Monday morning. A Stocktwits user saw a buying opportunity after the price target hike.

Another user sounded positive about Microsoft’s cloud demand.

Wells Fargo believes that, while recent performance has set a high benchmark, the company remains well-positioned to capitalize on the momentum in cloud services.

To meet the growing demand, Microsoft unveiled the Fairwater data center in Mt. Pleasant, Wisconsin, describing it as the most advanced “AI factory” it has developed to date. The data center is estimated to cost $3.3 billion and is expected to begin operating in early 2026, with plans to invest $4 billion in building a second data center.

Microsoft stock has gained over 25% year-to-date and 29% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_LUNR_Intuitive_Machines_resized_jpg_5655032711.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_falling_resized_jpg_c0ce61eff2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)