Advertisement|Remove ads.

Wendy's Stock Rises On Plans for New Restaurants, Long-Term Financial Targets: Retail's Upbeat

Shares of Wendy's Co (WEN) rose 2.44% on Friday following the fast-food chain's update on its long-term financial targets, which earned several analyst price hikes and lifted retail sentiment.

Looking out to 2028, its restaurant volume is expected to be between 8,100 and 8,300, and global systemwide sales are expected to be between $17.5 billion and $18 billion.

Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) are expected to be between $650 million and $700 million. Long-term net unit growth is projected at 3% to 4%, with annual systemwide sales growth expected between 5% and 6% and annual EBITDA growth of 7%-8%.

"The Wendy's brand has tremendous strength, and we will unlock its full potential, scaling our system to match the power of our brand," said Kirk Tanner, president and CEO.

"I'm excited about our upcoming innovation and collaborations that will build on our high-quality menu with fresh ingredients as we continue to elevate our customer focus, putting the customer at the center of everything we do."

CFO Ken Cook said the company is investing in building new restaurants worldwide and deploying technology to improve customer experience and increase restaurant profitability.

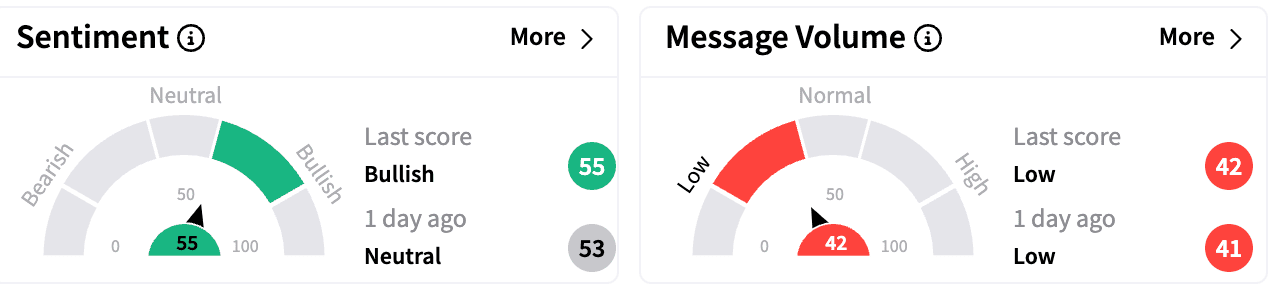

On Friday, sentiment on Stocktwits improved to 'bullish' from 'neutral'. Message volume was in the low zone.

One bullish commenter suggested an imminent reversal for the stock.

Another called Wendy's chili "the best on earth."

Following the update, Barclays raised the firm's price target to $17 from $16 with an 'Equal Weight' rating,

Barclay was reportedly "impressed" by the company's opportunity to drive U.S. comps, worldwide units, and ultimately EBITDA growth. However, it warned that even though the long-term outlook looked good, it was "all about execution."

Citi raised the firm's price target on Wendy's to $16.50 from $15.50; UBS analyst Dennis Geiger raised the price target to $16 from $15.

For its fiscal fourth quarter, Wendy's reported $0.25 in earnings per share, beating estimates of $0.24. Its revenue was $563.59, surpassing Wall Street expectations by 19%.

Wendy's stock is down 4.7% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218742693_jpg_8d1b39840a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553102_jpg_9cb79c1b5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)