Advertisement|Remove ads.

Whirlpool Still Bets On Trump Tariff Boost Even As It Cuts Outlook, Dividend On Pressure From Rivals Stockpiling Asian Goods

Whirlpool Corp (WHR) stock plummeted 14% in extended trading on Monday, after the home appliances maker cut its dividend and annual profit forecast, blaming Asian manufacturers stockpiling imports in the U.S. market.

The company, however, maintained its full-year revenue view, expecting the business to pick up in the latter part of the year. Its view is that as higher tariffs come into force, potentially prompting competitors selling foreign-made washing machines and dishwashers to raise prices, Whirlpool could see a sales boost.

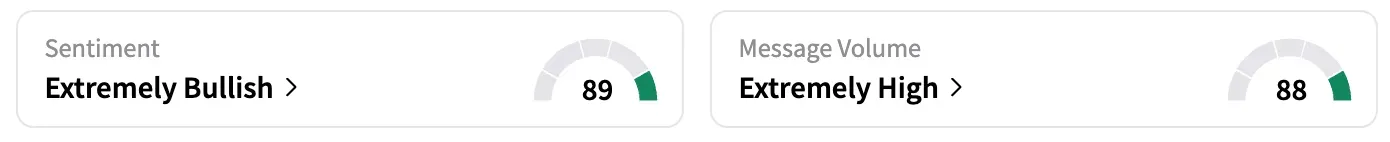

On Stocktwits, the retail sentiment flipped to 'extremely bullish' as of early Tuesday from a 'bearish' reading the previous day. Message volume surged over 5,000% in the last 24-hour period.

Several users viewed the share slide as an attractive entry point, while others expressed concerns about the dividend cut and waited for a response from institutional investors before taking a position.

If the after-hours decline carries into Tuesday's session, it would mark the stock's worst intraday performance in a year, deepening an already fragile stretch for the shares. Whirlpool stock is down 14.5%, compared to the 8.7% rise in SPDR S&P 500 ETF (SPY), which tracks stocks in the benchmark S&P 500 index.

Concerns surrounding Whirlpool's quarterly dividend, which was reduced to $0.90 per share from $1.75, were exacerbated by a weak second-quarter report.

Sales fell 5.4%, to $3.77 billion, missing analysts' consensus estimate of $3.85 billion from FactSet. Revenue from the North American market was the most affected, falling 10%, while global segment sales grew 7.5%.

Adjusted earnings per share were $1.34, also missing the expectation of $1.68.

For 2025, the company now expects adjusted earnings per share to be between $6 and $8, down from its previous guidance of $10. Sales are expected to be $15.8 billion.

CEO Marc Bitzer said the company’s performance remains under pressure from foreign rivals stockpiling Asian imports in the U.S. ahead of expected tariffs, flooding the market with excess supply and potentially limiting Whirlpool’s ability to raise prices.

The company indicated plans to offset some impacts from the tariffs through structural changes, promising $200 million in savings.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump2_jpg_ad63f384b5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_GE_Aerospace_resized_1_jpg_03f4fd7e4e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260447662_jpg_cd246b74f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2254924116_jpg_d54ffea07e.webp)