Advertisement|Remove ads.

Why Did AMD Stock Fall 4% Today?

Advanced Micro Devices (AMD) stock came under pressure on Thursday, drawing significant investor interest, after NVIDIA Corp. (NVDA) announced a $5 billion investment in Intel Corp. (INTC) stock.

Nvidia and Intel also said they will co-develop multiple lines of data center and PC technologies, aiming to advance AI, enterprise, and consumer applications.

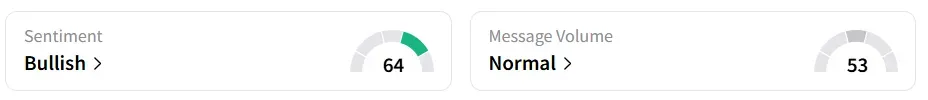

Following the update, AMD stock traded over 4% lower in Thursday’s premarket. AMD was the second-most trending stock on Stocktwits. However, retail sentiment around the stock jumped to ‘bullish’ from ‘bearish’ territory the previous day. Message volume improved to ‘normal’ from ‘low’ levels in 24 hours.

The stock saw a 121% increase in user message count over the last 24 hours. A bullish Stocktwits user expressed optimism about the stock.

Another user said they loaded up the stock after the dip.

Nvidia is investing $5 billion in Intel stock, agreeing to purchase shares at $23.28 apiece. Both parties plan to utilize Nvidia’s NVLink interconnect to tightly integrate Nvidia’s GPU (graphics processing unit) processing power with Intel’s x86 architecture, supporting high-performance computing needs.

In August, AMD announced a partnership with IBM to develop future computing systems that integrate quantum technology with high-performance traditional computing. This new approach is called quantum-centric supercomputing.

AMD also designs and develops high-performance computing and graphics technologies, including CPUs, GPUs, and embedded processors. The company's products are used in personal computers, data centers, gaming, and artificial intelligence.

AMD stock has gained over 31% year-to-date and over 7% in the last 12 months.

Also See: MicroAlgo Stock Gains 14% Today Pre-Market, Retail Chatter Explodes

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_OG_2_jpg_f92901a0f5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Shift4_logo_jpg_jpg_1845f04c23.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)