Advertisement|Remove ads.

Why Adobe Stock Rose In Today’s After-Hours Session

Adobe, Inc. (ADBE) shares climbed more than 2.5% in Thursday’s extended session after the company reported a beat-and-raise quarter.

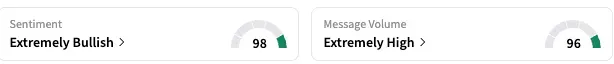

The Santa Clara, California-based company’s stock was among the top trending tickers on Stocktwits late Thursday. Retail sentiment toward Adobe stock stayed ‘extremely bullish’ (98/100) following the earnings, and the message volume on the stream was ‘extremely high’ as retailers discussed the quarterly report.

Adobe, a provider of document processing software and tools, announced record third-quarter revenue, driven by the strength of its subscription revenue for both its Digital Media and Digital Experiences businesses.

The key metrics for the third quarter of fiscal year 2025 are as follows:

- Adjusted earnings per share (EPS): $5.31 Vs. $5.18 consensus (Fiscal.ai)

- Revenue: $5.99 billion (11% YoY growth) Vs. $5.91 billion consensus

CEO Shantanu Narayen said, “Adobe is the leader in the AI creative applications category with AI-influenced ARR surpassing $5 billion and AI-first ARR already exceeding our $250 million year-end target.” ARR stands for annual recurring revenue, which is the predictable annual income for a subscription-based business.

“Given our customer strategy, AI product innovation and strong go-to-market execution, we’re pleased to once again raise our FY25 total revenue and EPS targets.”

Adobe’s full-year guidance now stands at $23.65 billion to $23.70 billion in revenue and $20.80 to $20.85 in adjusted EPS, which compares favorably to the average analysts’ estimates of $23.57 billion and $20.58, respectively.

The fourth-quarter guidance calls for revenue of $6.075 billion to $6.125 billion and adjusted EPS of $5.35 to $5.40. Wall Street’s consensus estimates are at $6.09 billion and $5.34.

Adobe stock is down over 21% for the year, even as the tech sector, represented by the Nasdaq Composite Index, trades at a record high.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Mogu Stock Soars To Nearly 4-Year High On $20M Crypto Bet In BTC, ETH, And SOL

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242061511_jpg_742d610600.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2164981884_1_jpg_100f5d0da3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_inflation_resized_f8af31ca5a.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)