Advertisement|Remove ads.

Why Barclays Sees Over 20% Upside Potential In This Data Centre Infrastructure Stock

- Barclays highlighted that Vertiv’s initial revenue and profit outlook for 2026 should comfortably exceed Wall Street’s consensus.

- Barclays analyst Julian Mitchell pointed to "substantial upside potential" above current earnings forecasts for both 2026 and 2027.

- In early December, Vertiv completed the $1 billion acquisition of Purge Rite Intermediate.

Barclays has upgraded the shares of Vertiv Holdings (VRT) to ‘Overweight’ from ‘Equal Weight’, citing stronger growth prospects for the data-center infrastructure provider.

The firm’s optimism about the company’s earnings and guidance has given a fresh reason to weigh the stock’s outlook with increased confidence.

Price Target Boost

Barclays also boosted its one-year price target on Vertiv to $200 from $181, saying recent pressure on the stock has opened what it considers a compelling entry point for long-term holders, according to TheFly.

The firm highlighted that Vertiv’s initial revenue and profit outlook for 2026 should comfortably exceed Wall Street’s consensus, with potential to surpass expectations in the coming quarters.

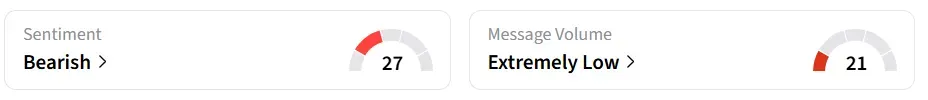

Vertiv stock traded over 4% higher in Friday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘bearish’ territory amid ‘extremely low’ message volume levels.

Vertiv provides integrated hardware, software, analytics, and services. The company supports data centers, communication networks, and industrial facilities with power, cooling and IT infrastructure solutions.

Analyst Rationale

Barclays analyst Julian Mitchell pointed to "substantial upside potential" above current earnings forecasts for both 2026 and 2027, noting the company’s historic tendency to set conservative guidance that later allows for “beat and raise” outcomes. That strategy could support stronger returns for shareholders if execution matches projections.

The opinion comes at a time when data center equipment and services have become increasingly important as artificial intelligence workloads drive increased spending on infrastructure.

In early December, Vertiv completed the $1 billion acquisition of Purge Rite Intermediate LLC, expanding its capabilities in mechanical flushing, purging, and filtration services for data centers and other mission-critical facilities.

Also See: 2026 Is Coming For Big Tech And AI With A Battery Of New Laws

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2185805420_fotor_2025011795638_6fbb0bb63f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_jpg_64b4ea4fc0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_war_jpg_f2a208ae56.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_M_and_A_deals_acquisitions_resized_jpg_a56d5b5e28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)