Advertisement|Remove ads.

BDSX Stock Shot Up 23% Pre-Market Today — What’s Fueling The Surge?

- The outlook for Q4 and FY2025 exceeds the analyst consensus estimate of $24.95 million and $84.65 million, respectively, according to Fiscal AI data.

- Biodesix said revenue gains were largely fueled by the company’s lung diagnostics segment.

- Test volumes climbed to 18,000 in Q4 and 62,600 for the year.

Biodesix Inc. (BDSX) stock surged over 23% in Monday’s premarket after the Colorado-based diagnostics firm provided a strong outlook for the fourth quarter (Q4) and fiscal year 2025.

The company expects Q4 revenue of $28.8 million, a 41% year-over-year (YoY) increase, while full-year revenue is estimated at $88.5 million, up 24% YoY. The outlook for Q4 and FY2025 exceeds the analyst consensus estimate of $24.95 million and $84.65 million, respectively, according to Fiscal AI data.

Growth Driven By Lung Diagnostics

Biodesix said revenue gains were largely fueled by the company’s lung diagnostics segment, which is estimated to have generated $25.2 million in Q4 and $79.2 million for the full year. The results reflect a 47% and 22% YoY increase, respectively.

Test volumes climbed to 18,000 in Q4 and 62,600 for the year, rising 23% and 15% from the previous year. The increase was driven by higher test volumes, stronger revenue per test, and about $1 million in collections from older claims.

“Biodesix finished 2025 with a strong fourth quarter, delivering full year estimated revenue of $88.5 million, exceeding the top end of our increased guidance of $84-$86 million.”

-Scott Hutton, CEO, Biodesix

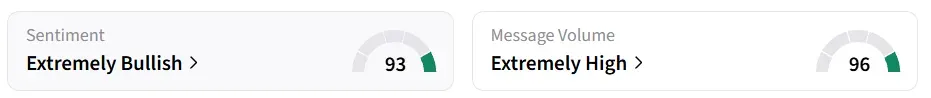

On Stocktwits, retail sentiment around Biodesix stock jumped to ‘extremely bullish’ from ‘bearish’ territory the previous day. Message volume shifted to ‘extremely high’ from ‘high’ levels in 24 hours.

Development Services

The company’s development services segment contributed an estimated $3.6 million in Q4 and $9.3 million for 2025, representing growth of 13% and 41% over the prior year, respectively.

“Based on our strong revenue flow-through and operating leverage, we are affirming our expectation of positive Adjusted EBITDA in the fourth quarter,” added Hutton.

Biodesix said it ended 2025 with $19.0 million in cash and cash equivalents, a 14% increase over the previous quarter.

BDSX stock declined by over 77% in the last 12 months.

Also See: Apple Captures 20% Of Global Smartphone Market, But Rising Memory Costs Cast Shadow On 2026 Growth

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259503553_jpg_13fb8f2e88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_122032465_jpg_9592f3bcfd.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Novavax_building_93bfe3bf8c.jpeg)