Advertisement|Remove ads.

Why Did Abercrombie & Fitch Stock Plunge Over 16% Today?

- Abercrombie & Fitch anticipates at least 6% growth in net sales for 2025, dialing back from its earlier projection.

- The company narrowed its earnings per share (EPS) outlook to a range of $10.30 and $10.40 from the previous range of $10.20 to $10.50.

- Capital expenditures are estimated at around $245 million, up from $225 million previously.

Abercrombie & Fitch Co. (ANF) on Monday trimmed its outlook for annual net sales growth, a move that rattled investors and pushed the retailer’s shares sharply lower.

The apparel retailer released its outlook for the fourth quarter (Q4) and the full fiscal year 2025.

Guidance Update And Market Reaction

Abercrombie & Fitch anticipates at least 6% growth in net sales for 2025, dialing back from its earlier projection that called for growth in the 6% to 7% range. The company expects an operating margin of approximately 13% and an effective tax rate near 30%.

The company narrowed its earnings per share (EPS) outlook to a range of $10.30 and $10.40 from the previous range of $10.20 to $10.50. The analysts' consensus estimate according to Fiscal AI data is $9.82.

Retailers across the sector have faced shifting consumer spending patterns, uneven demand for discretionary goods, and heightened sensitivity to pricing as inflation and interest rates pressure household budgets.

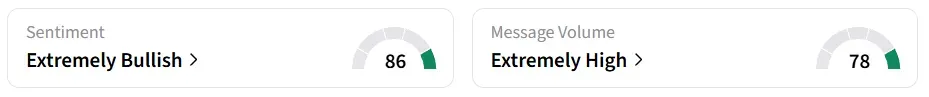

Abercrombie & Fitch stock tumbled by over 16% lower on Monday mid-morning. However, on Stocktwits, retail sentiment around the stock shifted to ‘extremely bullish’ from ‘bullish’ territory the previous day. Message volume shifted to ‘extremely high’ from ‘low’ levels in 24 hours.

Capital Expenditure Jumps

Capital expenditures are estimated at around $245 million, up from $225 million previously. Abercrombie & Fitch also plans roughly 40 net store openings, along with 40 remodels and right-sizing efforts.

For Q4, the retailer anticipates net sales growth of around 5%, with operating margins at roughly 14%.

Earnings per diluted share are expected between $3.50 and $3.60 with a consensus estimate of $3.60, according to Fiscal AI data. Share repurchases for the quarter are projected at approximately $100 million.

ANF stock has declined by over 23% in the last 12 months.

Also See: Apple To Use Google’s Gemini AI For Siri Overhaul: Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1238344200_1_jpg_9ec6a1a77a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_aurinia_pharmaceuticals_jpg_021df4af64.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235745938_jpg_f29c2bc96f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244949316_jpg_a5294e121e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_eli_lilly_logo_resized_9e8a8a2333.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_celsiusholdings_resized_jpg_5617397fa8.webp)