Advertisement|Remove ads.

Why Did BTDR Stock Decline 18% Today?

- Bitdeer’s $400 million convertible senior notes private placement is set to close on November 17.

- The unsecured notes will pay interest semi-annually beginning May 15, 2026.

- Bitdeer expects net proceeds of approximately $388 million or $446.4 million if the full $460 million is issued.

Bitdeer Technologies Group (BTDR) stock declined more than 18% on Thursday afternoon after the company announced the pricing of a private placement of convertible senior notes totaling $400 million.

The offering is set to close on Nov. 17, 2025, subject to customary closing conditions.

Terms And Conversion Details

The notes carry an annual interest rate of 4% and mature in 2031. Bitdeer also granted purchasers an option to acquire up to an additional $60 million in notes within 13 days of issuance.

The unsecured notes will pay interest semi-annually beginning May 15, 2026. Upon conversion, holders can receive cash, Class A ordinary shares of Bitdeer, or a combination thereof. The initial conversion rate is set at 56.2635 Class A shares per $1,000 principal amount, equating to a conversion price of roughly $17.77 per share.

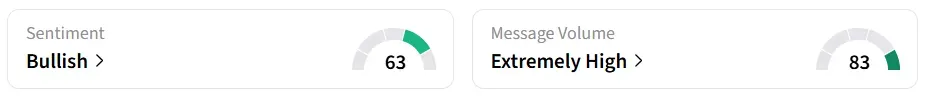

On Stocktwits, retail sentiment around Bitdeer stock jumped to ‘bullish’ from ‘neutral’ territory the previous day. Message volume improved to ‘extremely high’ from ‘high’ levels in 24 hours.

Use Of Proceeds

Bitdeer expects net proceeds of approximately $388 million or $446.4 million if the full $460 million is issued. The company plans to use funds to cover the costs of “capped call” transactions and repurchase its $200 million aggregate principal amount of 5.25% convertible senior notes due 2029.

A part of the proceeds will also be used to expand its data center operations, develop and manufacture ASIC-based mining rigs, grow its high-performance computing (HPC) and AI cloud business, and support general corporate purposes.

Bitdeer provides Bitcoin mining solutions. It handles equipment sourcing and logistics, as well as datacenter construction and daily operations. It also provides cloud computing tools for customers with high AI needs.

BTDR stock has lost over 48% year-to-date and gained over 4% in the last 12 months.

Also See: Disney Projects Higher Earnings, Doubles Buyback Target For 2026: Why Is The Stock Falling Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1760545615_jpg_9507fd561a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_lights_original_jpg_db38183cfe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)